To Share is to Show You Care!

In the fast-paced world of cryptocurrency trading, limited access to liquidity and trading pairs can often be a stumbling block for traders and investors. But fear not, as we unveil the best-kept secret that holds the key to unlocking unlimited liquidity and a wide array of trading pairs, paving the way to unparalleled financial freedom!

1. Understanding the Challenge: Limited Liquidity and Trading Pairs

Cryptocurrency markets are known for their rapid price movements and volatility. This volatility, while offering potential for substantial gains, can also present challenges. One major challenge is limited liquidity. Liquidity refers to how easily an asset can be bought or sold without causing significant price fluctuations. When liquidity is low, it becomes difficult to execute trades of a particular cryptocurrency quickly and at a desirable price. This can lead to slippage, where the executed price differs significantly from the expected price.

Moreover, limited trading pairs can compound this challenge. A trading pair consists of two different cryptocurrencies that can be traded against each other. For instance, in a BTC/ETH trading pair, Bitcoin (BTC) can be exchanged for Ethereum (ETH) and vice versa. A limited selection of trading pairs restricts the available investment opportunities and makes it harder to diversify a portfolio.

The lack of liquidity and trading pairs can deter traders and investors from entering the market, limit their trading strategies, and potentially hinder the growth of the cryptocurrency ecosystem as a whole.

2. The Game-Changer: Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a revolutionary concept that aims to disrupt traditional financial systems by leveraging blockchain technology. Unlike traditional finance, which relies on intermediaries like banks and financial institutions, DeFi operates in a decentralized manner. This means that financial activities occur directly between users, facilitated by smart contracts.

DeFi platforms offer a wide array of financial services, including lending, borrowing, trading, yield farming, and providing liquidity. One of the most transformative aspects of DeFi is its role in addressing the challenges of limited liquidity and trading pairs

2.1 Liquidity Pools

DeFi platforms use liquidity pools to provide liquidity for various cryptocurrencies. Users can contribute their assets to these pools and receive LP tokens in return. These tokens represent their share of the pool and can be redeemed later. Liquidity pools enhance the availability of assets for trading and can help mitigate the issue of limited liquidity.

2.2 Decentralized Exchanges (DEXs)

DeFi platforms often include decentralized exchanges. These exchanges operate without traditional order books, using AMMs to facilitate trades. This structure ensures continuous liquidity for various trading pairs and minimizes the impact of limited trading pairs.

2.3 Yield Farming and Staking

DeFi introduces the concept of yield farming, where users can stake their assets in protocols to earn rewards. This incentivizes users to provide liquidity to pools, thereby increasing liquidity and encouraging the creation of more trading pairs.

2.4 Global Accessibility

DeFi platforms are open to anyone with an internet connection, promoting financial inclusion on a global scale. This inclusivity allows individuals worldwide to access financial services and investment opportunities that might otherwise be unavailable due to geographic or institutional restrictions.

In summary, Decentralized Finance is the game-changer that addresses the challenges of limited liquidity and trading pairs. By providing innovative solutions and reshaping the financial landscape, DeFi empowers users to unlock new trading opportunities, access liquidity pools, and actively participate in shaping the future of finance.

3. Steps to Unlocking Unlimited Liquidity and Trading Pairs

Step1: Choose the Right DeFi Platform

Research and select a reputable DeFi platform that offers a wide range of liquidity pools and trading pairs. DeFi platforms are built on blockchain technology and enable users to engage in various financial activities, from trading and lending to borrowing and earning rewards.

Step2: Provide Liquidity to Pools

Liquidity pools are fundamental to DeFi platforms. To access liquidity, users can contribute their cryptocurrency assets to these pools. By doing so, they become liquidity providers and receive LP (Liquidity Provider) tokens in return. These tokens represent their share of the liquidity pool.

Step3: Explore Yield Farming

Yield farming involves leveraging your assets to earn additional tokens over time. Users stake their LP tokens or other cryptocurrencies in DeFi protocols, and in return, they receive rewards in the form of new tokens. Yield farming strategies can vary, and the potential rewards can be substantial.

Step4: Utilize Automated Market Makers (AMMs)

AMMs are a crucial component of DeFi platforms. They use smart contracts to facilitate trades directly between users, without the need for centralized intermediaries. AMMs ensure continuous liquidity by dynamically adjusting asset prices based on supply and demand within liquidity pools.

Step5: Diversify Your Portfolio

With access to a multitude of trading pairs, users can diversify their investment portfolios. Diversification involves spreading investments across different assets to minimize risks associated with volatility in any single asset. DeFi’s diverse range of trading pairs enables users to implement effective diversification strategies.

Step6: Stay Informed and Updated

The DeFi landscape is dynamic and rapidly evolving. To make informed decisions, users should stay informed about the latest projects, platform updates, security practices, and market trends. This knowledge empowers them to adapt to changes, protect their investments, and optimize their strategies.

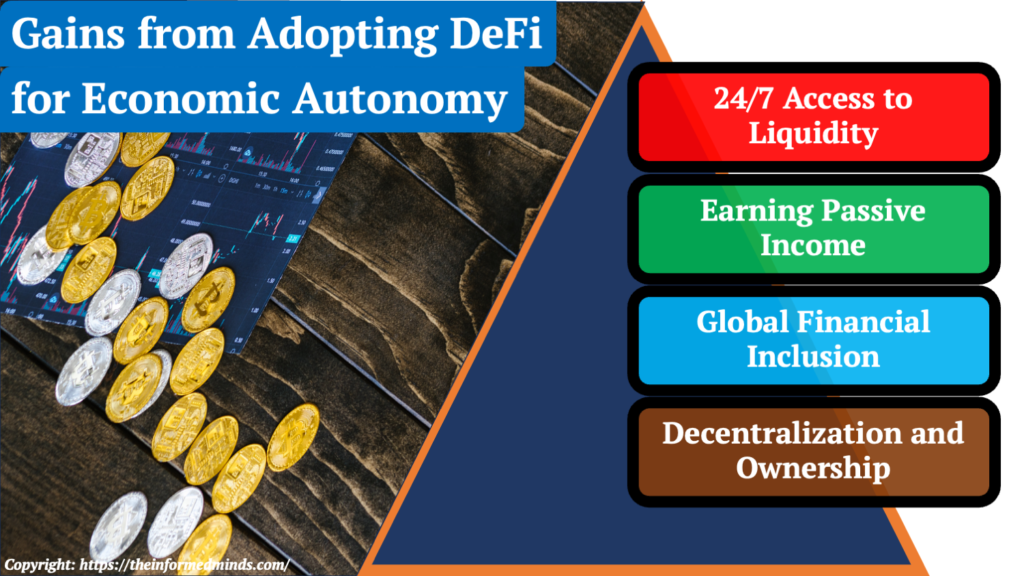

4. Benefits of Embracing DeFi for Financial Freedom

4.1 24/7 Access to Liquidity

Traditional financial markets have operating hours and limitations, but DeFi platforms operate 24/7. This accessibility allows users to trade, borrow, lend, and earn rewards at any time, providing greater flexibility in managing their financial activities.

4.2 Earning Passive Income

DeFi platforms offer opportunities for users to earn passive income through various mechanisms. By providing liquidity to pools, participating in yield farming, or engaging in other DeFi protocols, users can generate income in the form of trading fees, interest, and rewards without actively trading.

4.3 Global Financial Inclusion

DeFi is designed to be accessible to anyone with an internet connection. This inclusivity eliminates geographical barriers, enabling individuals worldwide to access financial services, invest, and participate in the global economy without relying on traditional financial intermediaries.

4.4 Decentralization and Ownership

DeFi operates on decentralized networks, meaning there are no intermediaries controlling users’ funds or transactions. This empowers users to have full control and ownership of their assets, reducing the risks associated with centralized platforms and promoting financial sovereignty.

Conclusion

The best-kept secret to unlocking unlimited liquidity and trading pairs lies in embracing the power of Decentralized Finance. By following the steps outlined in this guide, you can navigate the complex world of DeFi, tap into diverse trading opportunities, and pave your way to financial freedom. Embrace this paradigm shift and embark on a journey towards a more inclusive and prosperous financial future!

Frequently Asked Questions

Q1: Can you do unlimited day trades on crypto?

A: Day trading regulations for cryptocurrencies vary by jurisdiction. Some platforms and regions impose limits on the frequency of day trades to prevent potential risks associated with high-frequency trading. It’s important to understand the rules and limitations that apply to your specific location and chosen crypto exchange.

Q2: How do you get liquidity in crypto?

A: Liquidity in crypto can be obtained by participating in liquidity pools on decentralized exchanges (DEXs) or providing assets to lending platforms. Liquidity providers contribute their cryptocurrencies to these platforms, enabling smooth trading, earning fees, and facilitating various financial activities.

Q3: Which bot is the best for automated crypto trading?

A: The choice of a crypto trading bot depends on your trading strategy, technical expertise, and preferences. Some popular options include 3Commas, HaasOnline, and Gunbot. Researching and testing different bots will help you find the one that aligns with your needs.

Q4: Why can’t I trade crypto on Interactive Brokers?

A: As of my last update in September 2021, Interactive Brokers may not offer direct trading of cryptocurrencies due to their unique regulatory and technological considerations. However, this situation may change, so it’s advisable to check with Interactive Brokers directly for the most current information.

Q5: Can you make $1000 a day trading crypto?

A: Earning $1000 a day trading crypto is possible, but it’s important to note that crypto trading carries significant risks due to its volatility. Success requires a solid understanding of the market, risk management strategies, and consistent trading skills.

Q6: How many times can I trade in a day in crypto?

A: The frequency of trading in a day depends on your trading strategy, the platform you’re using, and any regulations that apply to your region. Some traders execute multiple trades a day, while others prefer longer-term approaches. Be aware of potential limitations set by your chosen exchange.

Q7: Why is liquidity locked in crypto?

A: Liquidity is locked in crypto to ensure stability and security within decentralized ecosystems. Locking liquidity helps prevent sudden price crashes and manipulation. It’s commonly seen in DeFi projects to provide assurance to users that there will be adequate liquidity for trading and transactions.

Q8: How do you farm liquidity?

A: Liquidity farming, also known as yield farming, involves providing liquidity to DeFi platforms in exchange for rewards. Users contribute assets to liquidity pools, earning fees and tokens. These rewards can then be further utilized or traded.

Q9: How can I get liquidity fast?

A: Getting liquidity quickly often involves contributing assets to well-utilized DeFi platforms or centralized exchanges. However, keep in mind that providing liquidity carries risks, and careful research is crucial to choose platforms wisely.

Q10: How much does a trading bot cost?

A: The cost of a trading bot varies widely based on its features, capabilities, and the provider. Some bots offer free versions with limited functionalities, while more advanced versions or subscription plans can range from tens to hundreds of dollars per month.

Q11: Are crypto trading bots illegal?

A: Crypto trading bots themselves are not inherently illegal. However, their legality depends on how they are used and the regulations of your jurisdiction. Bots can automate trading strategies, but it’s essential to comply with local laws and exchange rules.

Q12: Do trading bots make money?

A: Trading bots can potentially make money by executing trades based on pre-defined strategies. Their success depends on the effectiveness of the strategy, market conditions, and the bot’s configuration. It’s important to note that not all trades will be profitable.

Q13: How to be a crypto broker?

A: To become a crypto broker, you need to understand the cryptocurrency market, regulations, and have a platform to facilitate trades. You’ll need to comply with legal requirements and may need licenses depending on your jurisdiction.

Q14: Which crypto can I trade with Interactive Brokers?

A: As of my last update, Interactive Brokers offered trading of Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) futures contracts on their platform. It’s advisable to verify the current offerings directly with Interactive Brokers.

Q15: Can I transfer crypto out of Interactive Brokers?

A: Yes, you can usually transfer cryptocurrencies out of Interactive Brokers to external wallets or exchanges that support those cryptocurrencies. However, specific procedures and fees may apply, so consult Interactive Brokers’ guidelines for accurate instructions.

Q16: Can you make a living off day trading crypto?

A: Making a living off day trading crypto is possible for some skilled traders, but it’s extremely challenging. The crypto market’s high volatility and risks mean that losses can also occur. Adequate preparation, risk management, and continuous learning are crucial.

Q17: What is the average income of a crypto day trader?

A: The average income of a crypto day trader varies widely and is influenced by factors such as trading skills, capital invested, market conditions, and risk management. Some traders may achieve substantial profits, while others may experience losses.

Q18: What is the best crypto trading strategy?

A: There isn’t a one-size-fits-all answer to the best crypto trading strategy, as it depends on your risk tolerance, goals, and market conditions. Some popular strategies include day trading, swing trading, and long-term investing. It’s important to research and test strategies to find what suits you best.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.