To Share is to Show You Care!

In the ever-evolving world of cryptocurrencies, safeguarding your investments is paramount. With the rise of fraudulent projects and tokens, it’s crucial to stay vigilant and informed to protect your hard-earned money. In this comprehensive guide, we’ll explore the best strategies to ensure your crypto investments remain secure and fraud-free in 2023.

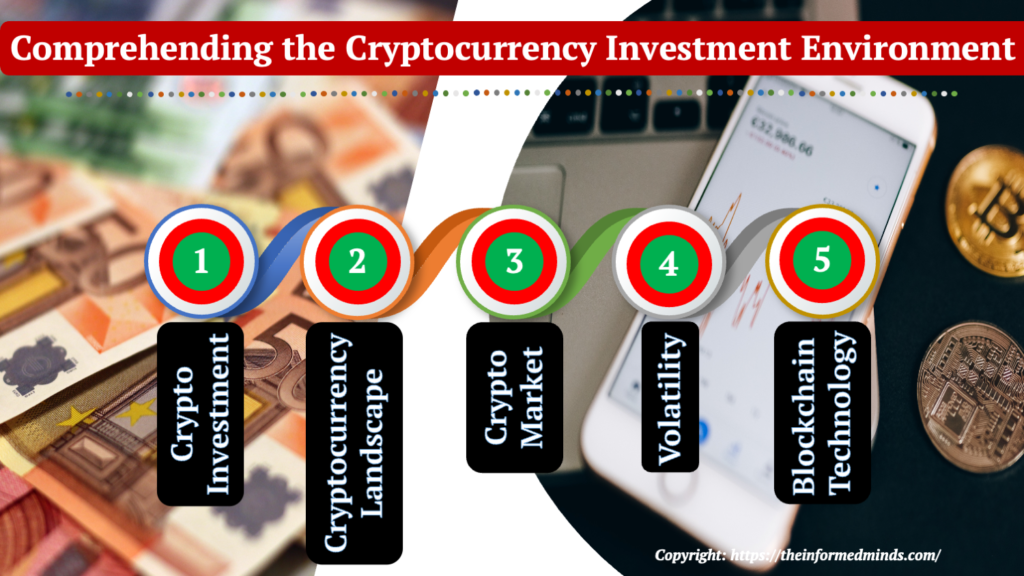

1. Understanding the Crypto Investment Landscape

Before you can protect your investments effectively, it’s crucial to have a solid understanding of the cryptocurrency investment landscape.

1.1 Crypto Investment

Crypto investments involve buying and holding various cryptocurrencies or tokens as a means of potentially generating profits. These investments can range from well-established coins like Bitcoin and Ethereum to newer, emerging projects.

1.2 Cryptocurrency Landscape

The cryptocurrency landscape refers to the overall environment in which cryptocurrencies operate. This includes various factors like the technology, regulatory aspects, market trends, and the ever-evolving list of cryptocurrencies.

1.3 Crypto Market

The crypto market is the collective marketplace where cryptocurrencies are bought, sold, and traded. It includes cryptocurrency exchanges, trading platforms, and over-the-counter (OTC) markets.

1.4 Volatility

Volatility is a significant characteristic of the crypto market. It refers to the rapid and unpredictable price fluctuations that cryptocurrencies can experience. Understanding the volatile nature of this market is crucial, as it can affect your investment decisions and risk management strategies.

1.5 Blockchain Technology

Cryptocurrencies are built on blockchain technology, a decentralized and transparent ledger. Understanding the basics of blockchain can help you assess the legitimacy and technology behind different crypto projects, enhancing your investment knowledge.

2. The Risks and Challenges

2.1 Fraudulent Tokens

Fraudulent tokens are cryptocurrencies created by unscrupulous individuals or teams with the sole intention of defrauding investors. These tokens often make unrealistic promises of high returns or use deceptive marketing tactics.

2.2 Phishing Attacks

Phishing attacks involve fraudsters attempting to trick you into revealing your private information or credentials, typically through fake websites or emails that mimic legitimate sources. Falling victim to phishing can lead to loss of funds or sensitive data.

2.3 Rug Pulls and Exit Scams

Rug pulls and exit scams are deceptive practices in the crypto world. A rug pull occurs when the creators of a project suddenly withdraw liquidity, causing the project’s value to plummet and leaving investors with losses. Exit scams involve founders abandoning a project after raising funds, leaving investors with worthless tokens.

2.4 Regulatory Risks

The regulatory landscape for cryptocurrencies can be uncertain and varies from one jurisdiction to another. Regulatory changes or government interventions can impact the value and legality of certain cryptocurrencies. Staying informed about the regulatory environment is vital.

2.5 Market Manipulation

Crypto markets are susceptible to manipulation, including pump-and-dump schemes and price manipulation tactics. Recognizing signs of market manipulation and avoiding investments in manipulated assets is essential for protecting your funds.

3. The Best Defense Against Fraud

Now, let’s explore the best strategies to defend against crypto fraud,

3.1 Do Your Research

Before investing in any cryptocurrency, conduct thorough research. Look for key information about the project, including its team members, the project’s whitepaper (a document outlining its goals and technology), and feedback from the crypto community. This will help you identify legitimate projects from potential scams.

3.2 Use Reputable Exchanges

Stick to well-established cryptocurrency exchanges that have a history of trustworthiness and security. Research the exchange’s reputation and user reviews to ensure your funds are safe.

3.3 Secure Your Wallet

Choose a secure wallet for storing your cryptocurrencies. Hardware wallets, like Ledger or Trezor, are considered highly secure. Ensure you keep your private keys (used to access your funds) safe and never share them.

3.4 Stay Informed

Stay updated on the latest news and developments in the crypto space. Join online crypto communities, follow credible influencers, and read reputable crypto news sources to stay informed about potential risks and market trends.

3.5 Enable Two-Factor Authentication (2FA)

2FA adds an extra layer of security to your accounts by requiring you to provide two forms of identification before gaining access. This can help protect your exchange accounts from unauthorized access.

3.6 Diversification Is Key

Diversification is a risk management strategy that involves spreading your investments across different assets. In the context of cryptocurrency:Instead of putting all your funds into a single project or cryptocurrency, consider spreading your investments across a variety of assets. Diversification helps reduce the impact of a single project’s failure on your overall portfolio. It’s a common strategy to minimize risk.

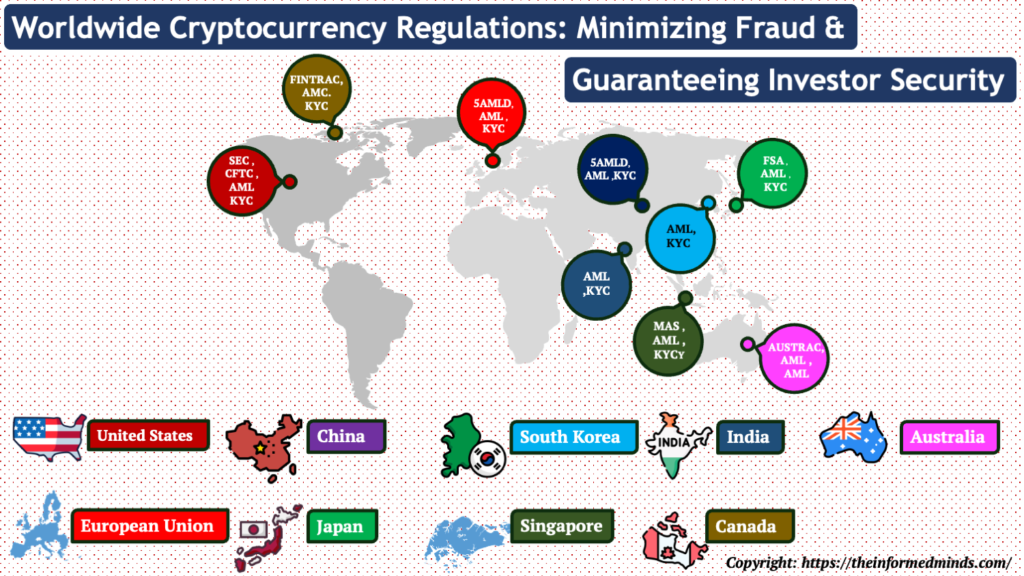

4. Global Cryptocurrency Regulations: Mitigating Fraud and Ensuring Investor Protection

Laws and regulations play a crucial role in mitigating fraudulent activities in the cryptocurrency space. However, it’s important to note that regulations can vary significantly from one country to another. Here’s an overview of how different countries address cryptocurrency regulations to combat fraud.

4.1 United States

In the United States, cryptocurrency regulations are intricate. The SEC oversees crypto as securities, the CFTC manages crypto derivatives, and FinCEN focuses on AML and KYC regulations, with state-level rules adding to the complexity.

4.2 European Union

The European Union (EU) has introduced the Fifth Anti-Money Laundering Directive (5AMLD), which mandates cryptocurrency businesses to adhere to AML and KYC requirements. The EU is working on broader regulations to create a unified legal framework for cryptocurrencies across its member states.

4.3 China

China has taken a strict stance on cryptocurrencies. The government has banned initial coin offerings (ICOs) and cryptocurrency exchanges, citing concerns over financial stability and fraud. However, they are actively exploring the development of a central bank digital currency (CBDC).

4.4 Japan

Japan has established a licensing system for cryptocurrency exchanges through the Financial Services Agency (FSA). This regulation aims to ensure consumer protection, security, and compliance with AML and KYC requirements.

4.5 South Korea

South Korea has also implemented regulations to combat fraud and protect investors. Cryptocurrency exchanges must adhere to AML and KYC rules and are subject to regular inspections. The country has also introduced laws governing tax on cryptocurrency gains.

4.6 Singapore

Singapore has a regulatory framework that seeks to balance innovation with investor protection. Cryptocurrency businesses must register with the Monetary Authority of Singapore (MAS) and comply with AML and KYC requirements.

4.7 India

India has been developing its cryptocurrency regulations. There have been discussions about potential bans and strict regulations, but the landscape is still evolving. The government has expressed concerns about fraud and illegal activities associated with cryptocurrencies.

4.8 Canada

Canada’s approach to cryptocurrency regulation involves the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), which enforces AML and KYC rules. Exchanges are required to register as money services businesses (MSBs) and adhere to reporting obligations.

4.9 Australia

Australia has introduced a regulatory framework through the Australian Transaction Reports and Analysis Centre (AUSTRAC). It mandates cryptocurrency exchanges to register and comply with AML and KYC rules.

These are just a few examples of how various countries are addressing cryptocurrency regulations to mitigate fraudulent activities. It’s essential for cryptocurrency users and investors to stay informed about the specific laws and regulations in their respective countries and to use regulated exchanges and services that comply with these rules to enhance their protection against fraud. Additionally, engaging in safe and secure practices, such as using reputable wallets and staying vigilant, is crucial for safeguarding your investments in the cryptocurrency space.

Stay Cautious, Stay Safe

In the world of cryptocurrencies, it’s essential to remain vigilant and take a cautious approach. If something appears too good to be true, it likely is. Safeguarding your crypto investments in 2023 and beyond requires a proactive mindset, continuous learning, and the diligent application of the strategies outlined in this guide. By doing so, you can better protect your investments from potential fraud and market volatility.

Frequently Asked Questions

Q1: How do I keep my crypto safe in 2023?

A: Keeping your crypto safe in 2023 involves a combination of strategies. Use reputable wallets, enable two-factor authentication (2FA) on exchanges, stay informed about security best practices, and research projects before investing to avoid scams.

Q2: Is 2023 a good year to invest in crypto?

A: The potential for crypto investments in 2023 depends on your risk tolerance and investment goals. The crypto market can be highly volatile, so it’s essential to conduct thorough research and consider diversifying your portfolio.

Q3: Is crypto expected to recover in 2023?

A: The recovery of the crypto market in 2023 is uncertain and subject to various factors, including market sentiment, regulatory developments, and adoption. It’s advisable to monitor the market closely and consider a long-term perspective.

Q4: Which crypto will boom in 2023?

A: Predicting specific cryptocurrencies that will boom in 2023 is challenging. It’s essential to conduct thorough research and consider assets with strong use cases and adoption potential. Diversification can also help manage risk.

Q5: What is the best crypto strategy in 2023?

A: The best crypto strategy in 2023 depends on your goals and risk tolerance. Common strategies include HODLing (holding long-term), day trading, and swing trading. Research, risk management, and staying informed are key.

Q6: How do I lock crypto for 5 years?

A: To lock your crypto for a long-term period, consider using a hardware wallet, create a secure backup of your wallet’s private keys, and store them in a safe place. Avoid frequent trading to maintain a long-term investment approach.

Q7: What is the next big thing in crypto 2023?

A: Predicting the next big thing in crypto is speculative. DeFi, NFTs, and blockchain interoperability are trends to watch, but it’s crucial to research and assess the potential of specific projects.

Q8: What cryptos to keep an eye on in 2023?

A: Cryptos to watch in 2023 may include established ones like Bitcoin and Ethereum, as well as promising projects in DeFi, NFTs, and blockchain interoperability. However, research and due diligence are essential.

Q9: How much will crypto go up in 2023?

A: Predicting the exact price movement of cryptocurrencies is challenging. Prices can be influenced by a variety of factors, including market sentiment, adoption, and macroeconomic conditions.

Q10: Will crypto bounce back in 2024?

A: The future of crypto in 2024 depends on multiple factors. Cryptocurrency markets have historically shown resilience, but the trajectory will depend on factors such as regulatory developments and market sentiment.

Q11: What happens to crypto in 2024?

A: The fate of crypto in 2024 remains uncertain. It could continue to evolve with technological advancements and regulatory changes, but market dynamics will play a significant role.

Q12: What is the scope of crypto in 2023?

A: The scope of crypto in 2023 is broad, with applications in finance, technology, and beyond. Cryptocurrencies, blockchain technology, and decentralized finance (DeFi) are expected to play significant roles.

Q13: Which crypto will make you rich in 2024?

A: No cryptocurrency can guarantee wealth, and investing in crypto carries risk. Successful investments require research, a long-term perspective, and diversification.

Q14: What crypto will explode in 2024?

A: Predicting specific cryptocurrencies that will explode in 2024 is speculative. It’s essential to research and consider projects with strong fundamentals and real-world use cases.

Q15: What crypto will skyrocket in 2024?

A: The cryptocurrencies that may experience significant price increases in 2024 will depend on market dynamics and various factors. It’s crucial to stay informed and conduct due diligence when investing.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.