To Share is to Show You Care!

In an increasingly digital world, consumer protection has become more crucial than ever. With the rise of online transactions and e-commerce, it is essential to know how to safeguard yourself and get chargebacks and refunds when necessary. In this blog post, we will explore the best strategies to protect your consumer rights and secure refunds in 2023.

1. Top Strategies for Safeguarding Crypto Consumer Rights and Ensuring Refund Security in 2023

1.1 Understand Your Consumer Rights

- Research Online Resources: Take advantage of online resources provided by consumer protection agencies and government websites. They often offer comprehensive guides to your rights as a consumer, helping you stay informed and knowledgeable.

- Join Consumer Forums: Engage with online consumer forums where individuals share their experiences and advice. Participating in these communities can provide valuable insights and support when dealing with consumer protection issues.

1.2 Keep Documentation

- Take Photos or Videos: Alongside saving receipts and order confirmations, consider taking photos or videos of the product or service received. Visual evidence can strengthen your case in situations where physical evidence is required.

- Save Email Correspondence: If you communicate with the seller through email, keep a record of these conversations. Email exchanges can serve as crucial evidence in case of disputes or misunderstandings.

1.3 Review Seller’s Policies

- Check for Hidden Fees: Scrutinize the seller’s policies for any hidden fees associated with returns or refunds. Sometimes, additional costs may be involved that could impact your decision-making process.

- Look for Satisfaction Guarantees: Some sellers offer satisfaction guarantees, promising a full refund if you’re not happy with your purchase. Prioritize purchasing from sellers who provide such guarantees for added peace of mind.

1.4 Act Promptly

- Document the Timeline: Maintain a timeline of all actions taken and communications made regarding the issue. Having a chronological record will help you stay organized and demonstrate your diligence if needed.

- Set Reminders: If there are specific deadlines for requesting refunds or chargebacks, set reminders to ensure you don’t miss any crucial dates.

1.5 Contact the Seller

- Be Calm and Polite: Approach the seller with a calm and polite attitude. Being respectful can lead to better communication and a higher likelihood of resolving the issue amicably.

- Escalate to Management: If you’re facing difficulties with customer service representatives, escalate your concerns to a higher level of management within the company. They might have more authority to resolve complex cases.

1.6 Know the Chargeback Process

- Understand Chargeback Codes: Familiarize yourself with the various chargeback reason codes provided by credit card issuers. Selecting the correct code will help facilitate a smoother chargeback process.

- Keep Channels Open: Maintain open lines of communication with your credit card issuer during the chargeback process. They may require additional information or updates to proceed with your request.

1.7 Be Persistent

- Follow Up Regularly: If your claim is taking time to process, follow up with the relevant parties regularly. A gentle nudge can sometimes expedite the resolution process.

- Consider Alternative Resolutions: In some cases, sellers may offer alternative resolutions, such as replacement products or store credits. Evaluate these options before deciding on a chargeback.

1.8 Check Buyer Protection Programs

- Read Program Terms Carefully: If you’re relying on a buyer protection program, read the terms and conditions thoroughly. Understanding the program’s limitations will help manage your expectations.

- File Claims Promptly: If you encounter an issue, file a claim with the buyer protection program as soon as possible, adhering to their specified timelines.

1.9 Monitor Your Statements

- Use Financial Management Apps: Utilize financial management apps that provide real-time updates on your transactions and account balances. These apps can alert you to any discrepancies swiftly.

- Save Past Statements: Keep digital or hard copies of your past statements for reference. This practice can be especially useful in cases where discrepancies arise much later after the original transaction.

1.10 Seek Legal Advice if Necessary

- Research Consumer Protection Attorneys: If you’re considering legal action, research and seek advice from experienced consumer protection attorneys. Choose someone well-versed in consumer law and handling similar cases.

- Check Pro Bono Options: If you’re facing financial constraints, inquire about pro bono legal services that may be available for consumer protection cases.

2. Global Overview of Crypto Consumer Protection Laws: Safeguarding Consumer Rights Worldwide

As of my last update, the regulation of cryptocurrencies and consumer protections in this domain was still evolving in many countries. Due to the fast-paced nature of the crypto industry, it’s important to note that laws and regulations might have changed significantly since then. Additionally, different countries have adopted various approaches, with some being more proactive in regulating cryptocurrencies, while others have taken a more cautious stance. Here is a general overview of the state of crypto consumer protections in a few countries:

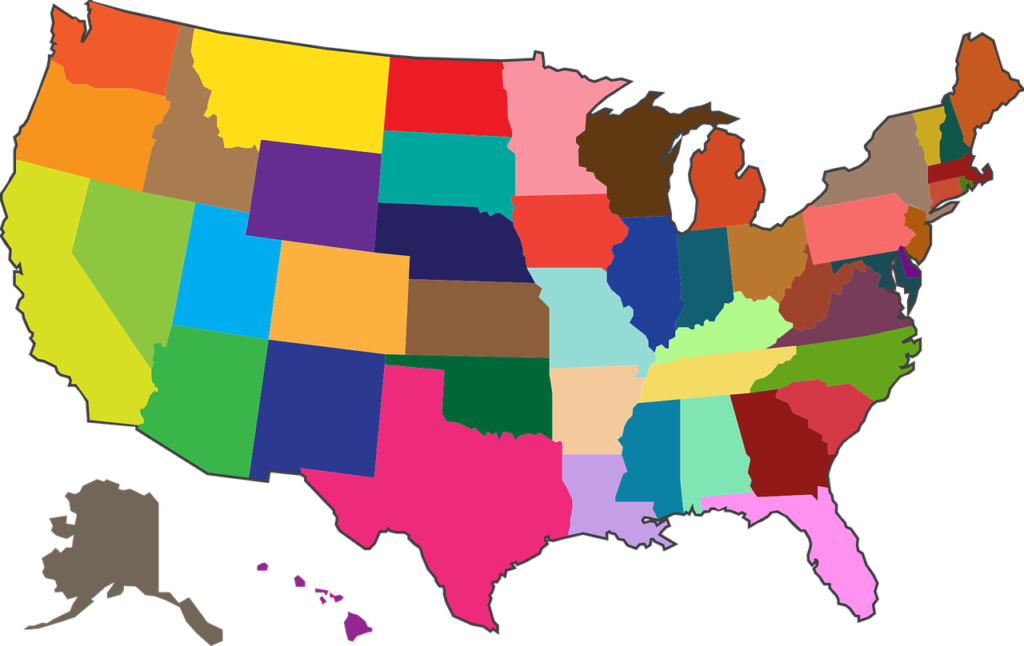

2.1 United States

The United States has taken a multi-agency approach to regulate cryptocurrencies. The Securities and Exchange Commission (SEC) has played a significant role in determining whether certain cryptocurrencies and initial coin offerings (ICOs) are classified as securities and subject to federal securities laws. Additionally, the Commodity Futures Trading Commission (CFTC) regulates cryptocurrencies as commodities. The U.S. has also witnessed a growing number of state-level initiatives to regulate crypto activities and protect consumers.

2.2 European Union

The European Union (EU) has been working on a coordinated approach to regulating cryptocurrencies. As of 2021, the EU’s Fifth Anti-Money Laundering Directive (5AMLD) was in effect, which brought virtual asset service providers (VASPs) under anti-money laundering and counter-terrorism financing regulations. The EU is also developing the Markets in Crypto-assets (MiCA) regulation, aimed at creating a comprehensive regulatory framework for cryptocurrencies.

2.3 Japan

Japan has been relatively early in regulating cryptocurrencies and has implemented a licensing system for cryptocurrency exchanges to ensure consumer protection and prevent illicit activities. The Japanese Financial Services Agency (FSA) oversees crypto regulations in the country.

2.4 South Korea

South Korea has taken measures to regulate cryptocurrencies to protect consumers and combat illegal activities. The country has banned anonymous trading, required exchanges to register with the Financial Intelligence Unit, and implemented various Know Your Customer (KYC) and anti-money laundering measures.

2.5 China

China has had a complex relationship with cryptocurrencies. While cryptocurrency trading is largely banned in China, the country has been actively exploring the use of blockchain technology. China has issued warnings to consumers about the risks associated with investing in cryptocurrencies.

2.6 India

On March 7th, 2023, the central government issued a notification to include digital assets, such as cryptocurrencies and virtual digital assets, along with fiat currencies, within the scope of the ‘Prevention of Money Laundering Act (PMLA)’. This move also covers activities related to the trading, safekeeping, and provision of financial services involving these digital assets.

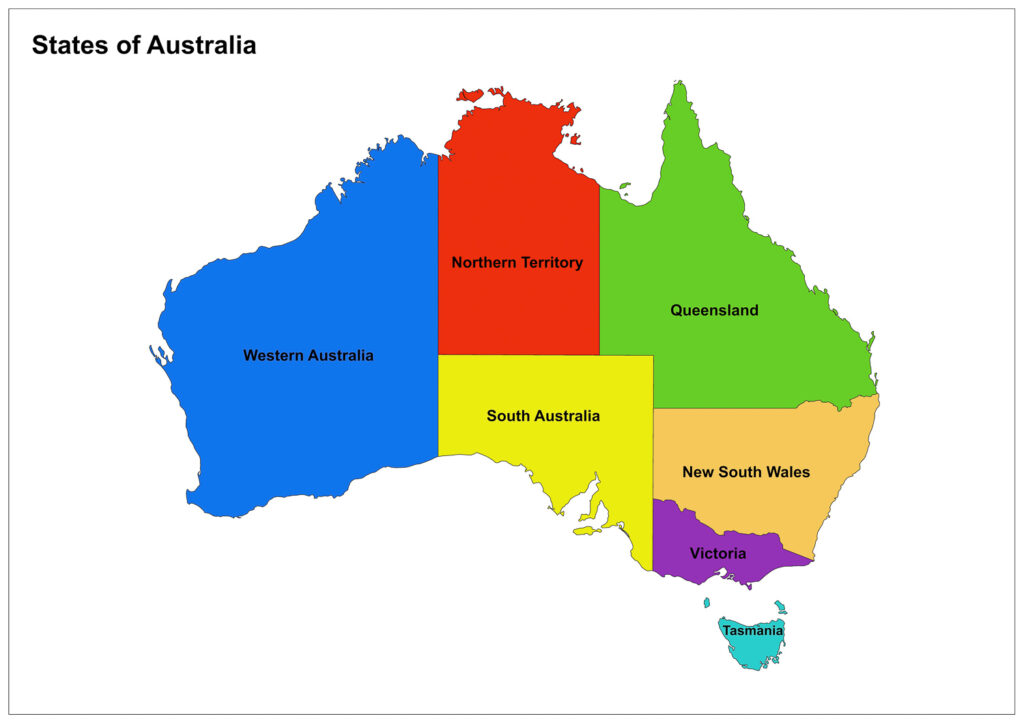

2.7 Australia

Australia has a well-established regulatory framework for cryptocurrencies. The Australian Securities and Investments Commission (ASIC) regulates cryptocurrency exchanges and ensures compliance with anti-money laundering and counter-terrorism financing laws.

It’s important to emphasize that the crypto regulatory landscape is dynamic and constantly evolving. Some countries have been more proactive in implementing consumer protections and regulatory frameworks, while others are still in the process of developing comprehensive rules for cryptocurrencies. As such, individuals engaging in cryptocurrency-related activities should stay updated on the latest developments in their respective countries and consider consulting legal experts to ensure compliance with local laws.

3. Conclusion

By following these expanded strategies, you’ll be well-equipped to navigate the world of consumer protections effectively in 2023. Understanding your rights, keeping thorough documentation, and persistently pursuing your claims will empower you to protect yourself as a consumer in the digital age.

4. Frequently Asked Questions

Q1: Can you chargeback on crypto?

A: No, cryptocurrencies are typically irreversible transactions. Once a cryptocurrency transfer is completed, it is challenging to initiate a chargeback like in traditional payment systems.

Q2: How do I get my money back from a chargeback?

A: In traditional payment methods like credit cards, a chargeback can be initiated by contacting your bank or credit card issuer. They will investigate the transaction and may refund your money if the charge is deemed fraudulent or unauthorized.

Q3: Can I get my money back from a scammer crypto?

A: Unfortunately, it is often difficult to get money back from scammers in the crypto space. Cryptocurrency transactions are pseudonymous, and scammers may cover their tracks, making it challenging to trace and recover funds.

Q4: Can I recover my scammed crypto?

A: Recovering scammed cryptocurrencies is a complex process. While you can report the scam to relevant authorities, retrieving the funds might be challenging due to the decentralized and anonymous nature of crypto transactions.

Q5: What qualifies for a chargeback?

A: Chargebacks are typically initiated for unauthorized transactions, fraudulent activities, or when goods/services were not delivered as promised.

Q6: Do banks reverse chargebacks?

A: Banks can reverse a chargeback if new evidence surfaces supporting the legitimacy of the original transaction. However, such instances are relatively rare.

Q7: Do you always get your money back with chargeback?

A: While chargebacks can be successful, there is no guarantee of always getting your money back, as the decision depends on the bank’s investigation and the specific circumstances of the case.

Q8: Can a crypto scammer be traced?

A: Tracing crypto scammers can be challenging due to the pseudonymous nature of blockchain transactions. However, some scammers have been traced through advanced investigative techniques.

Q9: How do I get my cryptocurrency back?

A: If your cryptocurrency is stolen or scammed, there is no central authority to reverse the transaction. Your best course of action is to report the incident to the appropriate authorities and hope for their intervention.

Q10: What should I do if I get scammed in crypto?

A: If you fall victim to a crypto scam, report the incident to law enforcement agencies and relevant financial authorities. Additionally, inform the cryptocurrency exchange or platform used in the transaction about the scam.

Q11: Do banks refund scammed money?

A: Banks may refund scammed money in certain cases, particularly if the scam involves traditional payment methods. However, crypto transactions are generally irreversible.

Q12: Can crypto be traced back to me?

A: Cryptocurrency transactions can be traced on the blockchain, but the real-world identities of users are often difficult to ascertain due to the decentralized and pseudonymous nature of cryptocurrencies.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.