To Share is to Show You Care!

In today’s fast-paced world, managing expenses and reducing unnecessary spending has become a paramount concern for individuals seeking financial stability. If you’re tired of seeing your hard-earned money disappear without a trace, it’s time to uncover the best budgeting strategy that can potentially save you thousands. Get ready to be amazed as we delve into the details and reveal the shocking sixth tip that can revolutionize your financial outlook.

The Power of Effective Budgeting

Budgeting isn’t just about penny-pinching; it’s a powerful tool that empowers you to take control of your financial destiny. With the right approach, you can achieve your financial goals, whether it’s building an emergency fund, paying off debt, or planning for your dream vacation. Let’s dive into the core of the best budgeting strategy and see how it can turn your financial situation around.

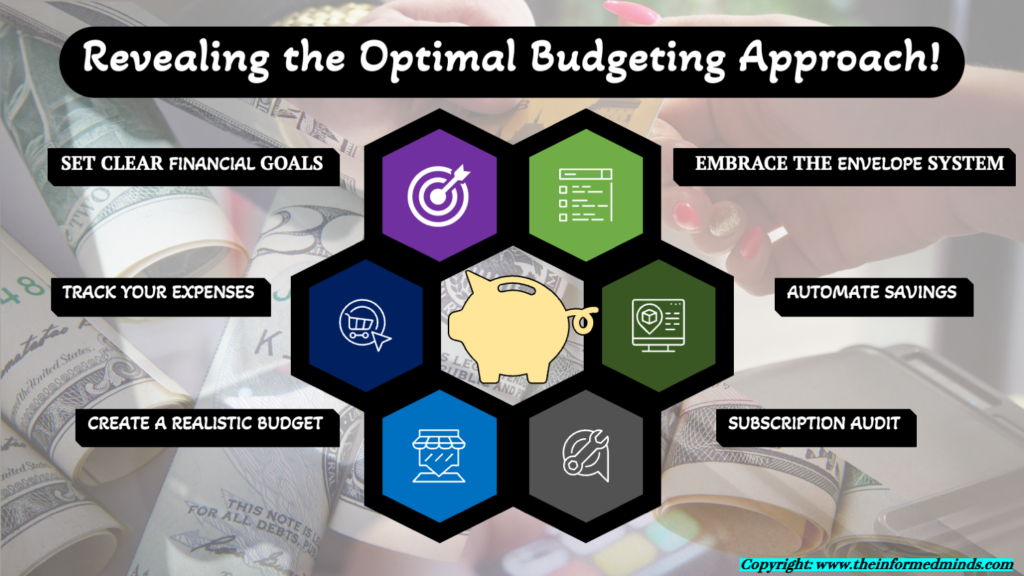

The Best Budgeting Strategy Unveiled

1. Set Clear Financial Goals

Setting clear financial goals is the foundation of effective budgeting. Start by identifying both short-term and long-term goals. Short-term goals could include paying off credit card debt, building an emergency fund, or saving for a vacation. Long-term goals might involve buying a house, funding your children’s education, or preparing for retirement. Having specific goals gives your budgeting efforts direction and purpose.

2. Track Your Expenses

Tracking your expenses involves recording every single expenditure, no matter how small. This step helps you become aware of where your money is going and reveals spending patterns. You can use budgeting apps or spreadsheets to categorize your expenses, making it easier to analyze where you might be overspending or areas where you can cut back.

3. Create a Realistic Budget

A realistic budget reflects your income and expenses accurately. Start with your monthly income and list all necessary expenses such as rent/mortgage, utilities, groceries, transportation, and insurance. Then allocate funds to savings, debt payments, and discretionary spending. The key is to strike a balance between your needs and wants while ensuring you’re saving enough to meet your goals.

4. Embrace the Envelope System

The envelope system is a tangible and effective way to manage discretionary spending. Assign specific envelopes for categories like entertainment, dining out, and shopping. Place the allotted cash for each category into its respective envelope at the beginning of the month. Once the cash in an envelope is gone, you can’t spend any more in that category. This method prevents overspending and helps you be more mindful of your expenses.

5. Automate Savings

Automating your savings involves setting up automatic transfers from your checking account to your savings or investment accounts as soon as you receive your paycheck. This strategy ensures that you’re consistently saving before you have a chance to spend the money impulsively. It’s a way to make saving a non-negotiable priority and helps you build your savings effortlessly.

6. Subscription Audit

The sixth tip involves conducting a thorough review of all your subscriptions. In the age of digital services, it’s easy to accumulate subscriptions for streaming platforms, software, magazines, gym memberships, and more. Many times, these subscriptions automatically renew without us even realizing it. Go through your bank statements and identify subscriptions that you rarely use or no longer need. Cancel those subscriptions to free up funds that could be better utilized elsewhere.

Conclusion

In a world where financial uncertainty is the norm, having a rock-solid budgeting strategy is your ticket to financial peace. By incorporating the best budgeting practices, you can save money, reduce unnecessary spending, and work towards achieving your dreams. Remember, it’s not about depriving yourself but making conscious choices that align with your goals. So, get started on the path to financial success – your future self will thank you.

Start your journey today and watch as the best budgeting strategy transforms your financial landscape, one penny at a time. Say goodbye to financial stress and hello to a brighter, more secure future.

Remember, it’s never too late to take control of your finances. Start implementing these tips today and witness the positive impact they can have on your financial well-being. Your wallet will thank you!

By implementing these strategies, you can take control of your finances, manage your expenses more effectively, and reduce unnecessary spending. Each strategy contributes to building a strong financial foundation and empowers you to work towards your financial goals with confidence. Remember, the key is consistency and making informed choices that align with your aspirations.

Frequently Asked questions

Q1: What is a good way to prevent unnecessary spending?

A: One effective way to prevent unnecessary spending is by tracking your expenses diligently. Keep a record of every expenditure, analyze your spending patterns, and identify areas where you can cut back.

Q2: Why is it important to cut unnecessary expenses?

A: Cutting unnecessary expenses is crucial because it helps you save money and allocate those funds towards your financial goals. It also prevents wasteful spending, improves your financial health, and reduces financial stress.

Q3: What is the 50 30 20 rule?

A: The 50 30 20 rule is a budgeting guideline where you allocate 50% of your income to needs (essential expenses like housing and groceries), 30% to wants (non-essential expenses like entertainment and dining out), and 20% to savings and debt repayment.

Q4: What is the practice of managing and/or reducing business expenses?

A: The practice of managing and reducing business expenses is commonly known as cost control. It involves implementing strategies to optimize spending, increase efficiency, and ensure that resources are utilized effectively to maximize profits.

Q5: How do you control overspending?

A: To control overspending, start by creating a budget and sticking to it. Use techniques like the envelope system or digital tools to track your expenses in real time. Avoid impulsive purchases and make informed spending decisions aligned with your financial goals.

Q6: How to manage expenses?

A: Managing expenses involves creating a comprehensive budget that includes all your income sources and categorizes your spending. Regularly track and review your expenses, identify areas for improvement, and make adjustments to stay within your budget limits.

Q7: What is the first step to take when reducing expenses?

A: The first step to reducing expenses is to evaluate your current financial situation. Understand your income, fixed costs, and variable expenses. Identify non-essential items and evaluate where you can make cuts without compromising essential needs.

Q8: Why is it important to manage costs?

A: Managing costs is vital for both personal finances and business operations. It ensures efficient resource allocation, prevents wastage, increases savings, supports financial stability, and contributes to overall financial success.

Q9: What are unnecessary expenses called?

A: Unnecessary expenses are often referred to as discretionary expenses. These are non-essential purchases or expenditures that can be eliminated or reduced without affecting your basic needs.

Q10: How to budget $5,000 a month?

A: To budget $5,000 a month, use the 50 30 20 rule as a starting point. Allocate $2,500 (50%) to needs, $1,500 (30%) to wants, and $1,000 (20%) to savings or debt repayment. Adjust the percentages based on your specific financial goals.

Q11: What is a 60 40 budget?

A: A 60 40 budget is a simplified budgeting approach where you allocate 60% of your income to essential expenses (needs) and 40% to non-essential expenses (wants and savings).

Q12: What is the 50 40 10 rule?

A: The 50 40 10 rule is a budgeting guideline used by some financial experts. It suggests allocating 50% of your income to essentials, 40% to discretionary spending, and 10% to savings or debt repayment.

Q13: What are the four options for managing costs?

A: The four options for managing costs are cost cutting (reducing spending), cost containment (keeping costs stable), cost avoidance (preventing unnecessary costs), and cost efficiency (maximizing value from each expense).

Q14: What are the six keys to controlling company spending?

A: The six keys to controlling company spending are setting clear spending policies, automating approvals, conducting regular audits, negotiating vendor contracts, analyzing spending patterns, and fostering a culture of cost-consciousness.

Q15: What is an example of a cost control strategy?

A: One example of a cost control strategy is implementing energy-efficient practices in a business, such as using energy-saving lighting, optimizing heating and cooling systems, and turning off equipment when not in use. This reduces utility expenses while minimizing environmental impact.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.