To Share is to Show You Care!

Saving for retirement is a crucial step towards securing your financial future. However, navigating through the myriad of strategies can be overwhelming. In this blog post, we will unveil the best and most effective retirement saving strategies that will leave you astonished. Get ready to discover the secrets to a secure future!

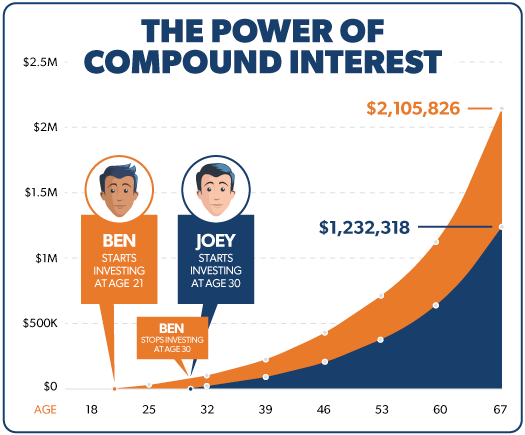

1. Start Early and Maximize Compound Interest

- Explain the power of compounding and how starting early can significantly boost your retirement savings.

- Highlight the benefits of regularly contributing to your retirement fund and let compound interest work its magic.

- Open a retirement savings account as soon as possible to kickstart your journey towards financial security.

- Educate yourself about the concept of compound interest and how it can exponentially grow your retirement savings over time.

- Take advantage of online compound interest calculators to see the long-term impact of starting early.

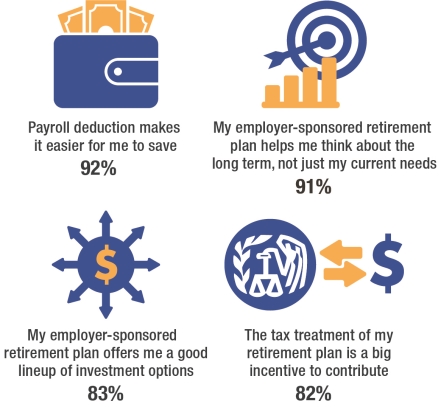

2. Embrace Employer-Sponsored Retirement Plans

- Discuss the advantages of employer-sponsored retirement plans like 401(k) or 403(b).

- Explain the concept of employer matching contributions and emphasize the importance of taking full advantage of this benefit.

- Familiarize yourself with the specific features and benefits of your employer’s retirement plan, such as vesting schedules and loan provisions.

- Consider increasing your contribution percentage each year or whenever you receive a salary raise to maximize the potential growth of your retirement savings.

- Regularly review and adjust your investment allocations within the retirement plan to ensure they align with your risk tolerance and long-term goals.

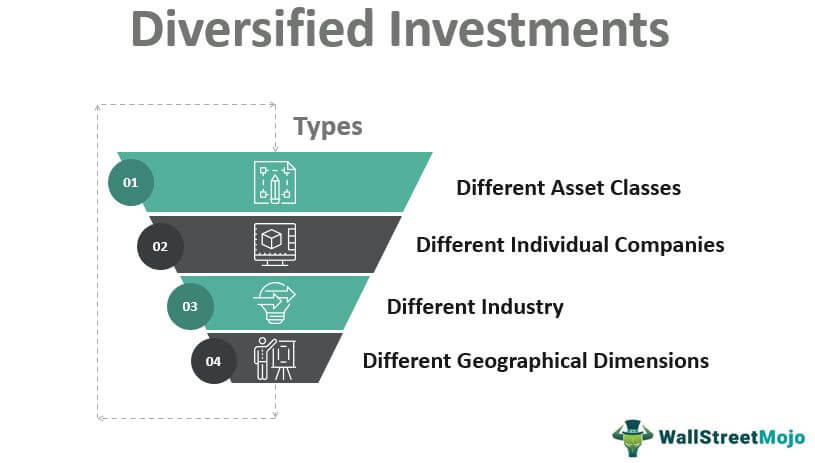

3. Diversify Your Investment Portfolio

- Discuss the significance of diversification in spreading risk and maximizing returns.

- Provide examples of different investment options such as stocks, bonds, mutual funds, and real estate.

- Research and explore different asset classes beyond traditional stocks and bonds, such as real estate investment trusts (REITs) or commodities.

- Consider diversifying internationally by investing in international index funds or global equities to spread your investment risk.

- Rebalance your investment portfolio periodically to maintain your desired asset allocation and ensure it aligns with your risk profile.

4. Utilize Tax-Advantaged Retirement Accounts

- Explain the benefits of tax-advantaged retirement accounts like Traditional IRAs and Roth IRAs.

- Discuss the tax advantages, contribution limits, and eligibility criteria for each type of account.

- Explore the option of a Health Savings Account (HSA) if you qualify, as it offers triple tax advantages and can be a powerful tool for covering healthcare expenses in retirement.

- Evaluate the pros and cons of Traditional and Roth IRAs to determine which one suits your financial situation and retirement goals.

- Consider consulting with a tax professional or financial advisor to optimize your contributions and withdrawals from tax-advantaged retirement accounts.

5. Take Advantage of Catch-Up Contributions

- Explain catch-up contributions and how they allow individuals aged 50 and above to save more for retirement.

- Highlight the increased contribution limits for retirement accounts and encourage readers to take advantage of this opportunity.

- Understand the specific catch-up contribution limits for different retirement accounts, such as 401(k) and IRA, to maximize your savings potential.

- If you’re married, explore the option of “catch-up spousal contributions” to boost your combined retirement savings.

- Evaluate your financial situation annually to determine if you qualify for catch-up contributions and take advantage of this opportunity whenever possible.

6. Don’t Miss Out on the Power of Automated Savings

- Explain the benefits of setting up automated contributions to your retirement savings.

- Highlight the convenience and discipline provided by automatic transfers and emphasize the importance of consistency.

- Set up automatic transfers from your paycheck directly into your retirement savings account to ensure consistent contributions.

- Consider utilizing budgeting apps or financial management tools that offer automated saving features, making it easier to allocate funds towards retirement.

- Monitor your automated savings regularly to ensure the contribution amounts remain aligned with your financial goals.

7. Reduce Debt and Minimize Financial Obligations

- Discuss the impact of debt on retirement savings and the importance of prioritizing debt repayment.

- Provide practical tips for managing and reducing debt, such as budgeting, refinancing, and prioritizing high-interest loans.

- Prioritize paying off high-interest debt first to reduce financial burdens and free up additional funds for retirement savings.

- Explore debt consolidation options to simplify your debt repayment process and potentially lower your interest rates.

- Create a detailed debt repayment plan with specific goals and timelines to stay motivated and track your progress.

8. Consider Downsizing Your Lifestyle

- Discuss the option of downsizing and its potential impact on retirement savings.

- Provide tips for evaluating and reducing unnecessary expenses to free up funds for retirement savings.

- Assess your current lifestyle and identify areas where you can reduce expenses without compromising your quality of life.

- Explore downsizing options such as moving to a smaller home or downsizing your vehicle to decrease monthly expenses and increase your savings capacity.

- Research the potential financial benefits of relocating to an area with a lower cost of living to stretch your retirement savings even further.

9. Seek Professional Financial Advice

- Emphasize the value of seeking guidance from qualified financial advisors.

- Discuss the benefits of professional advice in creating a personalized retirement plan and adapting it to changing circumstances.

- Consult with a certified financial planner or retirement specialist who can provide personalized guidance based on your unique financial situation and retirement goals.

- Regularly review your retirement plan with a financial advisor to ensure it remains on track and make any necessary adjustments along the way.

- Consider joining a retirement-focused workshop or seminar led by experts in the field to enhance your knowledge and gain valuable insights.

10. Stay Informed and Adjust Your Strategy Over Time

- Encourage readers to stay updated on market trends, tax regulations, and retirement planning strategies.

- Highlight the importance of regularly reviewing and adjusting their retirement savings strategy to ensure it remains aligned with their goals.

- Stay updated on changes in tax laws, retirement regulations, and investment trends that may impact your retirement savings strategy.

- Continuously educate yourself through books, podcasts, or online resources to stay informed about new retirement saving strategies and best practices.

- Regularly reassess your retirement goals and adjust your savings strategy accordingly to adapt to changing circumstances and ensure you’re on track for a secure future.

Conclusion

Saving for retirement is a lifelong journey that requires careful planning and smart strategies. By implementing the best and most effective retirement saving strategies discussed in this blog post, you can secure a future that exceeds your expectations. Start today, take action, and witness the power of these shocking strategies firsthand!

Ready to take control of your retirement? Start implementing these powerful strategies today and secure your future! Don’t wait—plan for retirement now and enjoy a worry-free future. Remember, it’s never too early or too late to start saving!

Frequently Asked Questions

Q1: How much do I really need to save for retirement?

A: The amount you need to save for retirement depends on various factors such as your desired lifestyle, expected expenses, and retirement age. It is generally recommended to aim for saving 10-15% of your annual income. However, it’s advisable to use retirement calculators or consult with a financial advisor to determine a more accurate estimate based on your specific circumstances.

Q2: Is saving $1,000 a month good for retirement?

A: Saving $1,000 a month for retirement is a commendable effort. The adequacy of this amount depends on factors such as your income, desired retirement age, and lifestyle expectations. It’s important to assess your long-term financial goals and consider factors like inflation and investment returns. Consulting with a financial advisor can help you determine if this savings rate aligns with your retirement objectives.

Q3: Is 5% enough to save for retirement?

A: Saving 5% of your income for retirement may not be sufficient for most individuals, especially considering increasing life expectancies and potential healthcare costs. While any savings towards retirement is a step in the right direction, financial experts generally recommend aiming for a higher savings rate, ideally around 10-15% or more, to ensure a comfortable retirement.

Q4: Is 10% enough to save for retirement?

A: Saving 10% of your income for retirement is a good starting point. However, the sufficiency of this amount depends on various factors such as your desired retirement age, expected expenses, and investment returns. To ensure a comfortable retirement, it’s advisable to aim for a savings rate of 15% or higher, considering potential inflation and unforeseen expenses.

Q5: Is $100K enough to retire on?

A: Whether $100,000 is enough to retire on depends on several factors, including your lifestyle expectations, anticipated expenses, and retirement age. While it’s challenging to provide a definitive answer, $100,000 alone may not provide a sustainable income for a lengthy retirement. It’s crucial to assess your overall financial situation, consider other sources of income, such as Social Security or pensions, and consult with a financial advisor to determine the feasibility of retiring with this amount.

Q6: How many people have $1,000,000 in savings?

A: The number of people with $1,000,000 in savings can vary. According to various reports, the percentage of individuals with $1,000,000 or more in savings tends to be relatively low. The exact statistics may change over time due to factors like economic conditions and individual saving habits. It’s worth noting that achieving a million-dollar savings goal typically requires consistent saving, investment growth, and a long-term perspective.

Q7: Can I retire at 62 with $400,000 in a 401(k)?

A: Retiring at 62 with $400,000 in a 401(k) is possible, but the sustainability of your retirement will depend on several factors. These include your anticipated expenses, lifestyle choices, healthcare costs, and potential additional sources of income such as Social Security or pensions. It’s advisable to create a comprehensive retirement plan, considering all financial aspects, and consult with a financial advisor to determine the feasibility and potential adjustments needed for your specific situation.

Q8: How much per week to save $5,000 in a year?

A: To save $5,000 in a year, you would need to save approximately $96 per week. This calculation assumes a 52-week year and does not account for potential fluctuations due to taxes or other financial factors. Adjustments may be necessary based on your individual circumstances and financial goals.

Q9: How far will $500,000 last in retirement?

A: The duration that $500,000 will last in retirement depends on various factors such as your planned retirement lifestyle, location, healthcare costs, and investment returns. To estimate the longevity of your savings, it’s crucial to consider your anticipated annual expenses and potential sources of income, such as Social Security or pensions. Consulting with a financial advisor can provide a more accurate projection based on your specific circumstances.

Q10: Is 35 too late to save for retirement?

A: No, 35 is not too late to start saving for retirement. While starting earlier provides more time to accumulate savings and benefit from compounding, it’s still possible to build a substantial retirement fund with diligent saving and investment strategies. It’s important to assess your financial situation, set realistic goals, and maximize your savings rate to catch up on any lost time.

Q11: Can I retire at 50 with $5 million?

A: Retiring at 50 with $5 million is possible, but it depends on various factors such as your desired lifestyle, expected expenses, investment returns, and potential additional sources of income. It’s essential to assess your financial goals, create a comprehensive retirement plan, and consult with a financial advisor to determine the feasibility of retiring with this amount.

Q12: How to retire in 10 years with no savings?

A: Retiring in 10 years with no savings is a challenging goal, but it may still be possible by implementing a comprehensive plan. Consider increasing your savings rate significantly, cutting down on expenses, and exploring additional income streams. Additionally, consult with a financial advisor who can provide guidance and help you create a realistic roadmap to achieve your retirement objectives within the given timeframe.

Q13: Is 28 too late to save for retirement?

A: No, 28 is not too late to start saving for retirement. While starting earlier allows for more time to accumulate savings, 28 still provides a significant timeframe to build a substantial retirement fund. It’s important to develop a savings strategy, increase your savings rate, and consider investment opportunities that align with your risk tolerance and long-term goals.

Q14: Is 29 too late to save for retirement?

A: No, 29 is not too late to start saving for retirement. While it’s advantageous to start saving as early as possible, individuals in their late 20s still have several decades to build a substantial retirement fund. It’s important to assess your financial situation, create a budget, and develop a long-term savings plan to secure a comfortable retirement.

Q15: How to retire in 5 years with no savings?

A: Retiring in 5 years with no savings is a challenging goal, but it may still be possible by adopting a highly disciplined approach. Consider reducing expenses to the bare minimum, maximizing your income through additional work or side gigs, and exploring potential windfalls such as inheritances or selling assets. It’s crucial to consult with a financial advisor who can help you create a realistic plan and navigate the complexities of retiring on such a tight timeline.

Q16: Can I retire at 60 with $2 million?

A: Whether you can retire at 60 with $2 million depends on various factors such as your expected expenses, lifestyle choices, healthcare costs, and potential additional sources of income. It’s important to assess your overall financial situation, including other retirement accounts, Social Security, or pensions, and consult with a financial advisor to determine the feasibility and potential adjustments needed for your specific situation.

Q17: What age can you retire with $2 million?

A: The age at which you can retire with $2 million depends on several factors such as your desired lifestyle, expected expenses, investment returns, and potential additional sources of income. By assessing your financial goals, creating a comprehensive retirement plan, and consulting with a financial advisor, you can determine the age at which you can comfortably retire with $2 million.

Q18: Can I retire at 70 with $500,000?

A: Retiring at 70 with $500,000 can be challenging, as this amount may not provide a sustainable income for a lengthy retirement. It’s important to assess your anticipated expenses, consider potential additional sources of income like Social Security, and consult with a financial advisor to create a comprehensive retirement plan that aligns with your financial goals and objectives.

Q19: How many Americans have $2 million in savings?

A: The number of Americans with $2 million in savings can vary over time and is subject to various economic factors. While precise statistics may fluctuate, having $2 million in savings typically represents a higher level of financial achievement and is not a common figure for the average American. The attainment of this level of savings often requires consistent saving, investment growth, and a long-term perspective.

Q20: Can I retire with $1 million dollars at 55?

A: Whether you can retire with $1 million at 55 depends on several factors such as your anticipated expenses, lifestyle choices, healthcare costs, and potential additional sources of income. It’s important to assess your overall financial situation, consider investment returns, and consult with a financial advisor to create a comprehensive retirement plan that aligns with your financial goals and objectives.

Q21: How many Americans have $500,000 in savings?

A: The number of Americans with $500,000 in savings can vary. While it’s challenging to provide an exact figure, having $500,000 in savings represents a significant accomplishment. It’s important to note that the distribution of savings amounts among the population varies, and many individuals may have varying levels of savings based on their unique financial circumstances, goals, and age groups.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.