To Share is to Show You Care!

In recent years, the world of finance has witnessed a revolutionary transformation, thanks to the advent of cryptocurrencies. Traditional banking systems are now faced with a new challenge: integrating and coexisting with the fast-paced world of digital currencies. In this blog post, we’ll explore how crypto is reshaping finance, the emotional aspects tied to this transformation, and the best ways to bridge the gap between crypto and traditional banking in 2023.

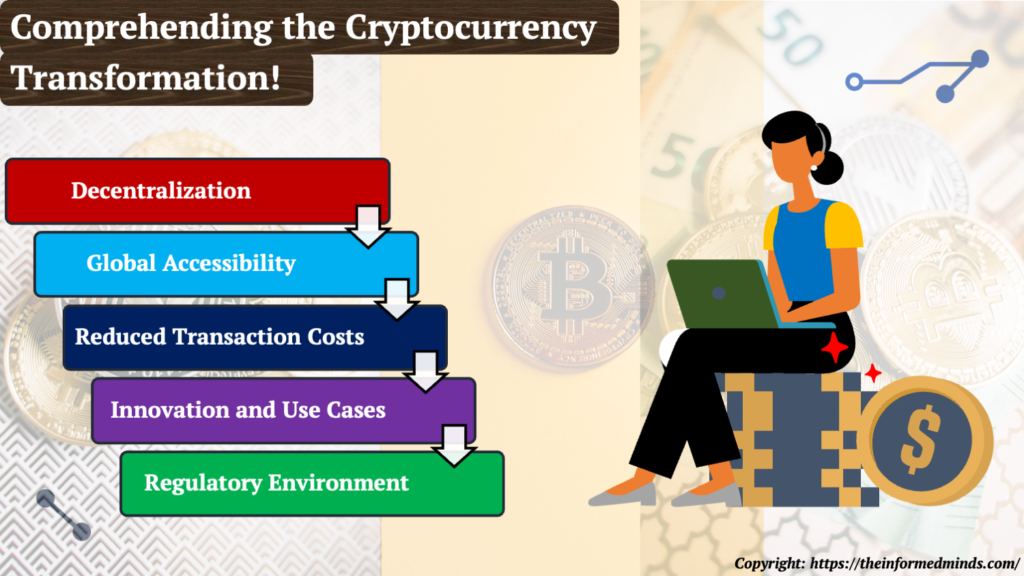

1. Understanding the Crypto Revolution

Cryptocurrencies have become a significant disruptor in the world of finance. They are digital or virtual currencies that use cryptography for security and operate on a decentralized ledger technology known as blockchain. Here’s a closer look at the key advantages of cryptocurrencies.

1.1 Decentralization

Unlike traditional banking systems that rely on centralized authorities (e.g., banks and governments), cryptocurrencies operate on a decentralized network of computers. This decentralization ensures that no single entity has control over the currency or the transactions, making it more secure and transparent.

1.2 Global Accessibility

Traditional banking systems have geographic limitations and may exclude individuals in underserved or remote areas. Cryptocurrencies, on the other hand, can be accessed by anyone with an internet connection. This accessibility has the potential to bring financial services to people worldwide, promoting financial inclusion.

1.3 Reduced Transaction Costs

Traditional financial transactions often involve fees and intermediaries. Cryptocurrencies can significantly reduce these costs. Because the technology operates peer-to-peer, it eliminates the need for intermediaries like banks, which can result in lower transaction fees and faster transfer times.

1.4 Innovation and Use Cases

Cryptocurrencies are not just digital versions of traditional money. They are at the forefront of technological innovation. Understanding the underlying blockchain technology and its potential applications is crucial. Blockchain has uses beyond cryptocurrencies, including supply chain management, voting systems, and smart contracts. Recognizing the diverse use cases and technological advancements in the crypto space can provide a broader perspective on its impact on finance and beyond.

1.5 Regulatory Environment

The regulatory landscape for cryptocurrencies is continuously evolving. Governments and financial institutions are actively working on establishing guidelines and regulations for the crypto market. Staying informed about the regulatory developments in your country and globally is essential. Regulations can impact the legality, taxation, and operational aspects of cryptocurrencies. Being aware of the legal framework helps you make compliant and informed decisions in your crypto investments.

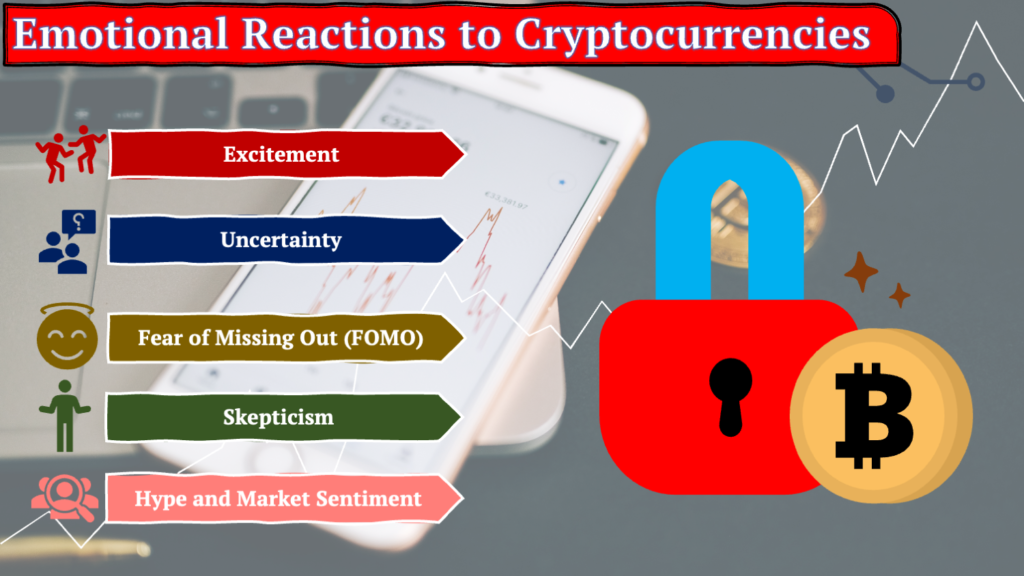

2. Emotional Responses to Crypto

The emergence of cryptocurrencies has evoked various emotional responses among investors, financial experts, and the general public. Here’s a closer look at these emotional reactions.

2.1 Excitement

Cryptocurrencies, particularly Bitcoin, have seen dramatic price increases in recent years. This has generated excitement among investors who anticipate substantial profits. The allure of quick wealth can be emotionally enticing.

2.2 Uncertainty

The crypto market is known for its extreme volatility. Prices can fluctuate dramatically over short periods, leading to feelings of uncertainty among investors. The lack of regulation and the speculative nature of some cryptocurrencies contribute to this uncertainty.

2.3 Fear of Missing Out (FOMO)

FOMO is a common emotional response in the crypto space. As prices rise rapidly, investors may fear missing out on potential gains. This fear can drive impulsive decisions and lead to emotional trading

2.4 Skepticism

Traditionalists may be skeptical about the long-term viability and security of cryptocurrencies. They may view them as a bubble or a passing fad. Concerns about fraud, hacking, and lack of regulation contribute to this skepticism.

2.5 Hype and Market Sentiment

The crypto market is highly influenced by sentiment, social media trends, and market hype. Understanding how market sentiment can drive price movements and being cautious of overly optimistic or pessimistic narratives is crucial. It’s important to make decisions based on research and analysis rather than succumbing to herd mentality or emotional reactions to short-term price fluctuations.

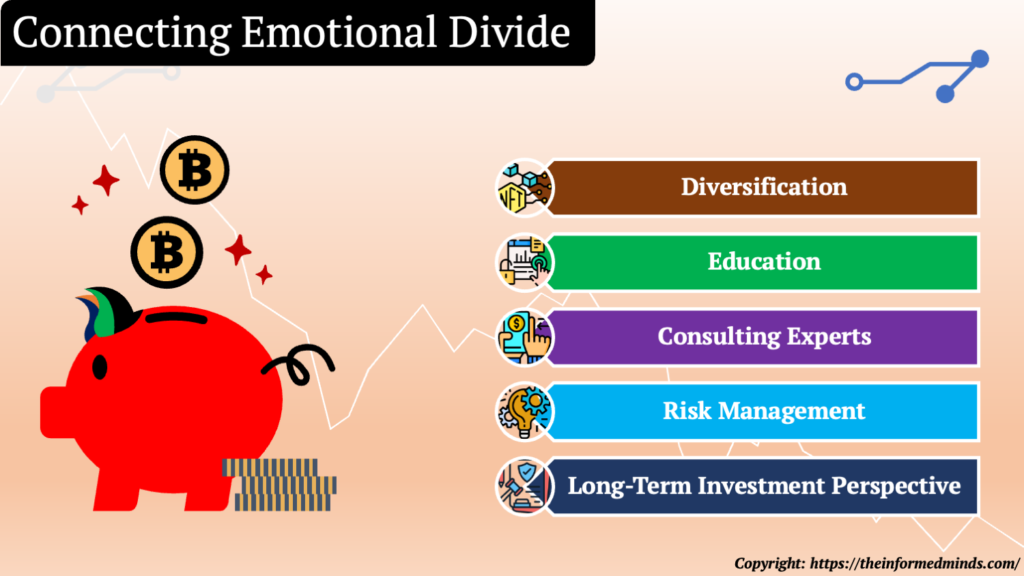

3. Bridging the Emotional Gap

To navigate the emotional rollercoaster of the crypto market and traditional finance, consider these strategies.

3.1 Diversification

Diversifying your investment portfolio means spreading your investments across different asset classes, including stocks, bonds, real estate, and cryptocurrencies. Diversification helps reduce risk and minimizes the impact of emotional responses to individual asset classes

3.2 Education

To make informed decisions and manage emotions, it’s essential to educate yourself about cryptocurrencies. Understand the technology, the specific cryptocurrencies you’re interested in, and their potential use cases. Education can help you separate hype from reality.

3.3 Consulting Experts

Seek advice from financial experts who specialize in cryptocurrencies. They can provide guidance, answer your questions, and help you develop a well-informed investment strategy. Consulting experts can help you make more rational decisions in the face of market volatility.

3.4 Risk Management

Develop a risk management strategy that includes setting clear objectives, defining your risk tolerance, and implementing stop-loss orders. Having a structured approach to managing risk can help prevent emotional decision-making, such as panic selling during market downturns.

3.5 Long-Term Investment Perspective

In addition to diversification, consider adopting a long-term investment perspective. Recognize that the crypto market can be highly volatile, and short-term price fluctuations are common. Focusing on the long-term potential of your investments can help reduce the emotional stress of day-to-day price swings. Setting clear long-term goals and sticking to your investment strategy can be a key factor in success.

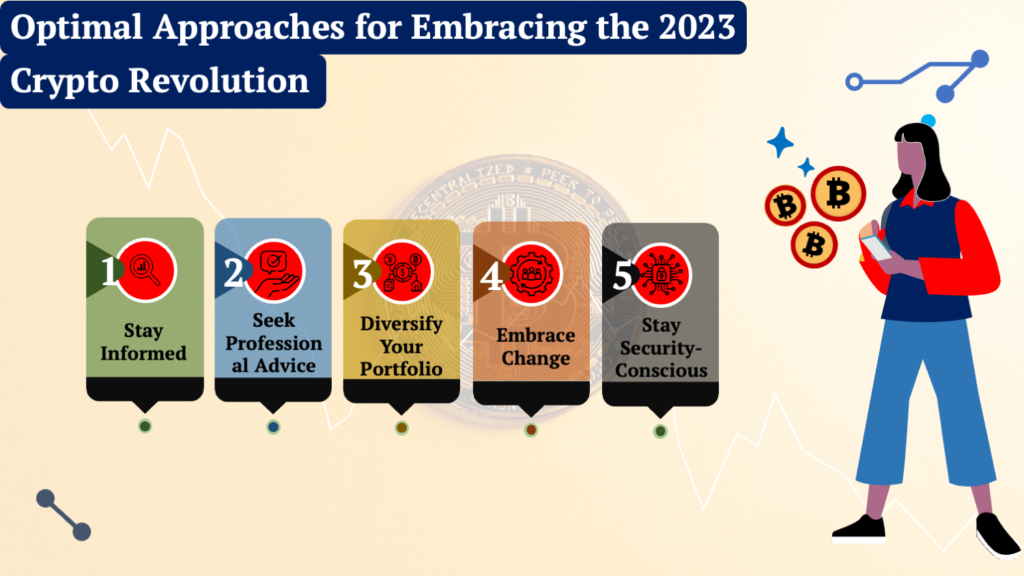

4. The Best Way to Embrace the Crypto Revolution in 2023

As we look ahead to 2023, consider the following key takeaways for embracing the crypto revolution.

4.1 Stay Informed

Continuously educate yourself on developments in both traditional and crypto markets. Subscribe to reputable sources of information, follow industry news, and keep an eye on regulatory changes that could impact the crypto landscape.

4.2 Seek Professional Advice

Consider consulting with a financial advisor or cryptocurrency expert who can provide personalized guidance based on your financial goals and risk tolerance. They can help you make well-informed investment decisions.

4.3 Diversify Your Portfolio

Building a diversified portfolio that includes a mix of assets, including cryptocurrencies, can help you achieve a balanced risk-return profile. Diversification spreads risk and can reduce the emotional impact of market fluctuations on your overall wealth.

4.4 Embrace Change

Be open to the idea that traditional banking and cryptocurrencies can coexist harmoniously. While cryptocurrencies represent a disruptive force, they can complement traditional financial systems and provide opportunities for innovation.

4.5 Stay Security-Conscious

With the increasing popularity of cryptocurrencies, the risk of cyberattacks and scams has also risen. Embracing the crypto revolution in 2023 includes being security-conscious. Use reputable cryptocurrency wallets, enable two-factor authentication, and follow best practices for securing your digital assets. Staying vigilant against potential threats is vital for a safe and successful crypto experience.

Conclusion

The fusion of cryptocurrencies and traditional banking presents both challenges and opportunities. By understanding the emotional dynamics at play and implementing the best practices discussed, you can navigate the evolving financial landscape in 2023 with greater confidence and success. Embrace the change, stay informed, and bridge the emotional gap for a more secure financial future.

Frequently Asked Questions

Q1: How does cryptocurrency affect traditional financial market practices?

A: Cryptocurrency has introduced significant disruptions to traditional financial market practices by offering decentralization, reduced transaction costs, and faster cross-border transactions. It challenges the traditional banking system by providing an alternative means of transferring and storing value.

Q2: What are the barriers to adopt and integrate crypto into the traditional financial system?

A: Barriers to adopting and integrating crypto into the traditional financial system include regulatory challenges, security concerns, lack of mainstream understanding, and resistance from established financial institutions. Regulatory clarity and technology advancements are crucial for successful integration.

Q3: How is cryptocurrency different from traditional finance?

A: Cryptocurrency differs from traditional finance as it operates on decentralized blockchain technology, is not tied to any central authority, and offers global accessibility. It also tends to be more volatile, and transactions are conducted directly between users without intermediaries.

Q4: What are the challenges of the crypto ecosystem and financial stability?

A: The crypto ecosystem faces challenges related to regulatory uncertainty, security breaches, fraud, and the potential for market manipulation. These factors can impact financial stability and require proactive measures to mitigate risks.

Q5: What are the negative impacts of cryptocurrency?

A: Negative impacts of cryptocurrency include price volatility, the potential for fraud and scams, energy consumption concerns (especially for proof-of-work cryptocurrencies), and its association with illegal activities like money laundering and tax evasion.

Q6: Is traditional banking under threat from cryptocurrency?

A: While cryptocurrency poses challenges to traditional banking, it is not an imminent threat to its existence. However, it does encourage traditional banks to innovate and adapt to changing customer demands, especially in terms of digital services and cross-border transactions.

Q7: What are 2 disadvantages of using cryptocurrencies in today’s globalized world?

A: Two disadvantages of using cryptocurrencies in today’s globalized world are price volatility, which can affect the value of assets, and the lack of consumer protections in the event of disputes or issues with transactions.

Q8: What is the main problem in regulating cryptocurrencies?

A: The main problem in regulating cryptocurrencies is the lack of a unified and comprehensive global regulatory framework. The decentralized and borderless nature of cryptocurrencies makes it challenging for individual countries to enforce regulations effectively.

Q9: What are the barriers to investing in crypto?

A: Barriers to investing in crypto include the complexity of the technology, lack of regulatory clarity, concerns about security, the potential for investment losses due to market volatility, and the need for specialized knowledge.

Q10: Will cryptocurrency replace traditional currency?

A: It’s unlikely that cryptocurrency will completely replace traditional currency in the foreseeable future. Cryptocurrencies are more likely to coexist with fiat currencies, serving as an alternative form of digital money.

Q11: Which two things make cryptocurrency different from traditional currency?

A: Two key differences between cryptocurrency and traditional currency are decentralization (not controlled by a central authority like a central bank) and the use of blockchain technology for recording transactions.

Q12: What are the pros and cons of cryptocurrency?

A: Pros of cryptocurrency include decentralization, lower transaction costs, accessibility, and the potential for high returns on investment. Cons include price volatility, regulatory uncertainty, security risks, and the association with illegal activities.

Q13: What is the biggest problem with crypto?

A: One of the biggest problems with crypto is its price volatility. The value of cryptocurrencies can fluctuate significantly over short periods, making them a risky asset for both investors and users.

Q14: What are two issues associated with crypto assets?

A: Two issues associated with crypto assets are the potential for hacking and security breaches of exchanges or wallets, as well as their role in enabling illegal activities, including money laundering and tax evasion.

Q15: Is crypto a financial stability risk?

A: Cryptocurrency can pose financial stability risks, primarily due to its volatility and its potential to facilitate illegal activities. However, the extent of this risk varies depending on factors like regulatory oversight and market adoption.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.