To Share is to Show You Care!

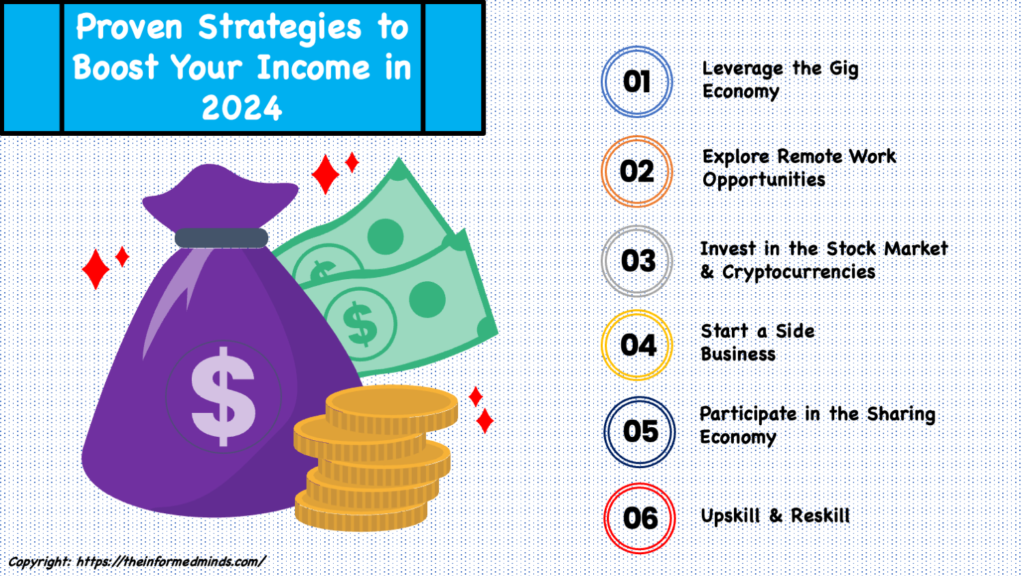

In today’s ever-evolving financial landscape, finding ways to increase your income has become more accessible and innovative than ever. Whether you’re looking to supplement your existing salary or create a new revenue stream, there are numerous strategies to explore. Here are some of the latest and most effective methods to boost your income in 2024.

1. Leverage the Gig Economy

The gig economy continues to grow, offering flexible work opportunities that can be easily integrated into your schedule.

- Freelancing: Websites like Upwork and Fiverr connect freelancers with clients seeking various services, from graphic design to writing.

- Ride-sharing and Delivery: Companies like Uber, Lyft, and Door Dash provide flexible income options by driving or delivering food in your spare time.

- Task-based Platforms: Platforms such as TaskRabbit allow you to get paid for completing tasks like home repairs, cleaning, and moving.

2. Explore Remote Work Opportunities

Remote work has become a staple in many industries, allowing you to earn from anywhere.

- Remote Jobs: Many companies now offer remote positions. Websites like FlexJobs and Remote.co list jobs that can be done from home.

- Virtual Assistance: Providing administrative support remotely is a growing field. Platforms like Belay and Time Etc. can help you find virtual assistant roles.

- Online Tutoring: Share your knowledge and earn money by teaching subjects you’re proficient in. Websites like VIP Kid and Chegg Tutors connect tutors with students.

3. Invest in the Stock Market and Cryptocurrencies

Investing is a proven way to grow your wealth over time. With the advent of technology, it’s easier than ever to get started.

- Stock Market: Apps like Robinhood and E*TRADE allow you to trade stocks with minimal fees.

- Cryptocurrencies: Platforms like Coinbase and Binance enable you to invest in digital currencies, which have gained popularity for their potential high returns.

- Robo-Advisors: Services like Betterment and Wealth front provide automated investment management, making it simple for beginners to invest wisely.

4. Start a Side Business

Entrepreneurship is a powerful way to increase your income, allowing you to capitalize on your skills and passions.

- E-commerce: Launch an online store using platforms like Shopify or Etsy. Selling handmade products, drop shipping, or print-on-demand items are popular options.

- Blogging and Affiliate Marketing: Create a blog on a topic you’re passionate about and monetize it through affiliate marketing, sponsored posts, and ads. Tools like WordPress and Bluehost can help you get started.

- Consulting: If you have expertise in a particular field, offer consulting services. Platforms like Clarity.fm can connect you with clients seeking your advice.

5. Participate in the Sharing Economy

The sharing economy enables you to earn money by renting out assets you own.

- Real Estate: Rent out a room or property on Airbnb or VRBO. This can be particularly lucrative in high-demand tourist areas.

- Vehicle Rentals: Platforms like Turo allow you to rent out your car when you’re not using it.

- Equipment Sharing: Rent out equipment like cameras, tools, or even clothing on platforms like Fat Llama or Rent the Runway.

6. Upskill and Reskill

Investing in your education can open up new income opportunities.

- Online Courses: Websites like Coursera, Udemy, and LinkedIn Learning offer courses in a wide range of subjects. Completing these can help you gain new skills that are in demand.

- Certifications: Obtain certifications in high-demand fields such as IT, project management, or digital marketing to enhance your resume and increase your earning potential.

- Networking: Join professional organizations and attend industry conferences to connect with potential employers and clients.

Conclusion

Increasing your income in 2024 involves a combination of leveraging new technologies, exploring flexible work opportunities, and continuously improving your skillset. Whether you choose to dive into the gig economy, invest in the stock market, or start your own business, there are plenty of strategies to explore. By staying informed about the latest trends and being proactive, you can significantly boost your financial well-being.

Frequently Asked Questions

Q1: How to Make $1000 a Month Passively?

To make $1000 a month passively, consider the following options:

- Dividend Stocks: Invest in high-yield dividend stocks. These can provide a regular income stream through dividends.

- Real Estate Crowdfunding: Platforms like Fundraise allow you to invest in real estate projects without needing to buy properties directly.

- Peer-to-Peer Lending: Lend money through platforms like Lending Club or Prosper and earn interest on repayments.

- Create an Online Course: Share your knowledge on platforms like Udemy or Teachable and earn passive income as students enroll.

- Affiliate Marketing: Promote products or services on your blog or social media and earn commissions on sales through affiliate links.

Q2: How to Passively Make $2000 a Month?

To achieve $2000 a month in passive income:

- Rental Properties: Invest in rental properties and earn rental income.

- Dividend Growth Investing: Focus on stocks that not only pay dividends but also have a history of increasing them.

- Create Digital Products: Sell e-books, printables, or software on platforms like Amazon Kindle or Etsy.

- Build a Blog: Monetize through ads, sponsored posts, and affiliate marketing.

- Invest in REITs: Real Estate Investment Trusts (REITs) provide exposure to real estate markets and pay dividends.

Q3: What is the Fastest Way to Increase Your Income?

The fastest way to increase your income:

- Freelancing: Offer services on platforms like Upwork or Fiverr.

- Gig Economy Jobs: Drive for Uber or deliver for DoorDash.

- Part-Time Jobs: Take on a part-time job in addition to your current job.

- Sell Unwanted Items: Use platforms like eBay, Craigslist, or Facebook Marketplace.

- Consulting: Offer your expertise to businesses in need of your skills.

Q4: How to Make $500 a Month Passive Income?

To make $500 a month in passive income:

- High-Yield Savings Account: Earn interest on your savings.

- Index Fund Investing: Invest in index funds that provide regular dividends.

- Write an eBook: Publish on Amazon Kindle and earn royalties.

- YouTube Channel: Create content and monetize through ads and sponsorships.

- Cashback Apps: Use apps like Rakuten and get cashback on your purchases.

Q5: How to Make 10K a Month?

To make $10,000 a month:

- Start a Business: Launch a scalable business model.

- Real Estate Investment: Buy and rent out multiple properties.

- High-Ticket Freelancing: Offer premium services with high rates.

- Online Courses and Memberships: Develop and sell online courses.

- Stock Market: Invest substantially in the stock market with a focus on growth stocks.

Q6: How to Make $100,000 Per Year in Passive Income?

To earn $100,000 per year in passive income:

- Invest in Real Estate: Own multiple rental properties.

- Build a Diversified Portfolio: Combine dividend stocks, bonds, and real estate investments.

- Create and Sell Online Courses: Generate consistent sales over time.

- Develop a Subscription Service: Offer a membership site with recurring billing.

- Automated Online Businesses: Use dropshipping or affiliate marketing websites.

Q7: How to Make 2K in a Day?

To make $2,000 in a day:

- High-Stakes Consulting: Offer specialized consulting services.

- Freelancing Projects: Complete large-scale freelance projects.

- Sell High-Value Items: Sell luxury items like jewelry or electronics.

- Day Trading: Engage in stock or cryptocurrency day trading.

- Event Planning: Plan and manage high-budget events.

Q8: How Can I Make a $5K Monthly Passive Income?

To make $5,000 a month in passive income:

- Invest in Rental Properties: Manage multiple properties for rental income.

- Dividend Investing: Invest heavily in high-dividend-paying stocks.

- Create a Successful Blog: Generate income from ads, sponsored content, and affiliate marketing.

- Develop a Mobile App: Earn through in-app purchases and ads.

- Build a YouTube Channel: Consistently create valuable content and monetize through ads.

Q9: How to Make 30K Fast?

To make $30,000 quickly:

- Sell a High-Value Asset: Sell property, a vehicle, or collectibles.

- High-Commission Sales: Engage in sales jobs with high commissions.

- Crowdfunding: Launch a crowdfunding campaign for a compelling project.

- Consulting: Offer expert consulting services to businesses.

- Day Trading: Make short-term trades in stocks or cryptocurrencies.

Q10: How to Become a Millionaire?

To become a millionaire:

- Save and Invest Early: Start investing early in life.

- Diversify Investments: Spread investments across stocks, real estate, and other assets.

- Increase Income Streams: Create multiple sources of income.

- Control Spending: Maintain a budget and minimize unnecessary expenses.

- Continuous Learning: Stay informed about financial trends and opportunities.

Q11: What Are Two Ways You Can Increase Your Own Income?

Two ways to increase your income:

- Freelance Work: Offer services online in your area of expertise.

- Side Business: Start a small business or side hustle that complements your skills.

Q12: How Can I Make More Money ASAP?

To make more money as soon as possible:

- Gig Economy Jobs: Drive for ride-sharing or deliver food.

- Sell Unwanted Items: Quickly sell items you no longer need online.

- Short-Term Freelancing: Take on quick freelance jobs.

Q13: How to Earn $5,000 Per Month?

To earn $5,000 a month:

- Consulting Services: Offer high-value consulting.

- Online Business: Start and scale an online business.

- Freelance Work: Work on high-paying freelance projects.

- Real Estate Investments: Own and rent out properties.

- Digital Products: Sell digital products like courses or eBooks.

Q14: How to Make $100 a Day?

To make $100 a day:

- Gig Economy: Drive for Uber or Lyft.

- Freelancing: Offer services on platforms like Fiverr.

- Online Tutoring: Teach subjects online.

- Sell Handmade Items: Use Etsy to sell crafts.

- Affiliate Marketing: Promote products and earn commissions.

Q15: How to Make Passive Income When You’re Broke?

To make passive income when you’re broke:

- Start a Blog: Use free platforms and monetize with ads.

- YouTube Channel: Create content and earn from ads.

- Affiliate Marketing: Promote products with no upfront costs.

- Write an eBook: Publish on Kindle with minimal expenses.

- Cashback and Rewards Programs: Use cashback apps to save and earn money.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.