To Share is to Show You Care!

In the fast-paced world of cryptocurrencies, safeguarding your crypto fortune is paramount. With the ever-present threat of blockchain forks and updates, it’s crucial to stay informed and prepared. In this comprehensive guide, we’ll walk you through the best emotional solution to tackle these challenges head-on in 2023. Buckle up for a crypto journey that will empower you to protect your investments and navigate the crypto landscape with confidence.

1. Understanding the Crypto Landscape

Before we delve into the emotional solution, let’s briefly understand the crypto landscape in 2023. The market is as dynamic as ever, with new coins and tokens constantly emerging. With this landscape in mind, here are some key points to consider:

- The rise of decentralized finance (DeFi) platforms.

- The importance of non-fungible tokens (NFTs) and their impact.

- The ongoing evolution of blockchain technology.

2. The Emotional Rollercoaster of Crypto

Investing in cryptocurrencies can be an emotional rollercoaster. The volatility of crypto markets, coupled with the uncertainty surrounding blockchain forks and updates, can take a toll on your emotional well-being. It’s essential to recognize and address these emotions to make informed decisions.

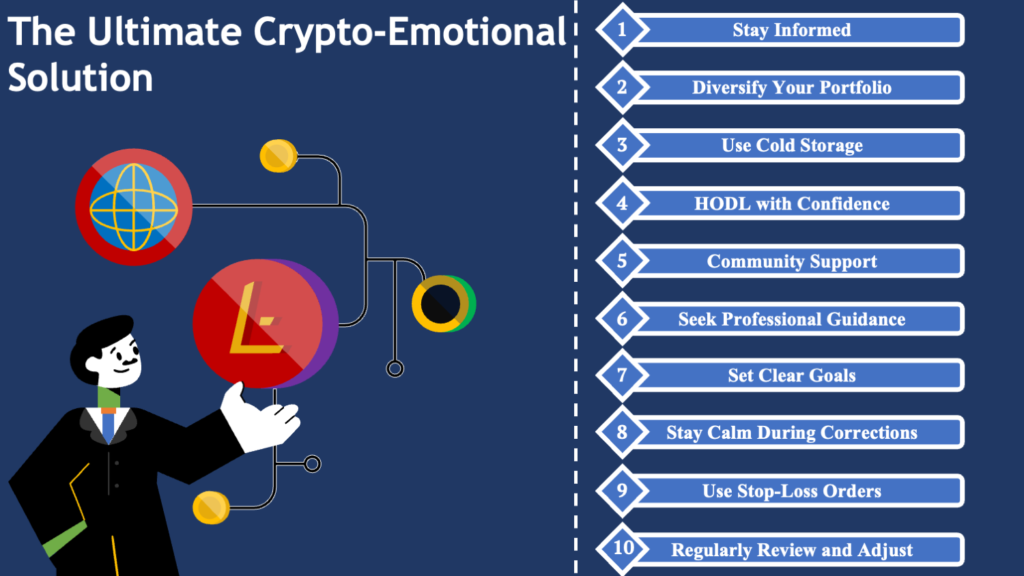

3. The Best Emotional Solution

3.1 Stay Informed

Staying informed in the world of cryptocurrencies is crucial for making well-informed decisions and managing emotional stress. Here’s how you can achieve this:

- Reliable Sources: Rely on trusted cryptocurrency news websites, forums, and social media channels to stay updated. Avoid sensationalized or unreliable sources that can exacerbate emotional fluctuations.

- Subscribe to Newsletters: Subscribe to newsletters from reputable sources to receive regular updates in your email inbox.

- Follow Influential Figures: Follow key figures in the crypto industry on social media platforms. They often share valuable insights and updates.

3.2 Diversify Your Portfolio

Diversification is a risk management strategy that can help reduce the emotional impact of crypto market fluctuations:

- Spread Your Investments: Allocate your funds across different cryptocurrencies rather than concentrating all your assets in a single coin or token. Diversification can lower the impact of a negative event affecting one specific asset.

- Research and Select Carefully: When diversifying, conduct thorough research on each asset to understand its technology, use case, and potential for growth.

3.3 Use Cold Storage

Protecting your crypto assets is essential for emotional well-being, and cold storage is a secure option:

- Hardware Wallets: Consider investing in hardware wallets like Ledger or Trezor. These physical devices store your private keys offline, making them immune to online threats.

- Paper Wallets: Paper wallets involve printing your private keys and keeping them offline. Ensure they are stored securely.

3.4 HODL with Confidence:

The crypto market can be highly volatile, leading to emotional stress. HODLing, or holding onto your investments, requires emotional strength:

- Long-Term Vision: Develop a long-term perspective on your investments. Understand the fundamental value of the cryptocurrencies you hold and their potential for future growth.

- Ignore Short-Term Noise: Emotional reactions to daily price fluctuations can lead to impulsive decisions. Learn to filter out short-term noise and focus on your long-term goals.

3.5 Community Support

Engaging with the crypto community can provide emotional support and valuable insights:

- Join Forums and Social Media Groups: Participate in cryptocurrency forums, subreddits, and social media groups dedicated to your chosen cryptocurrencies. Discussing your concerns and questions with like-minded individuals can be reassuring.

- Attend Meetups and Conferences: When possible, attend cryptocurrency meetups and conferences in your area. Networking with others in the field can foster a sense of belonging.

3.6 Seek Professional Guidance

If you find it challenging to manage the emotional aspects of crypto investing, consider seeking help:

- Financial Advisor: Consult with a financial advisor who understands cryptocurrencies. They can provide guidance on portfolio management and risk assessment tailored to your financial goals.

- Therapist or Counselor: A therapist or counselor experienced in cryptocurrency-related issues can help you address anxiety, stress, and decision-making challenges associated with crypto investments.

3.7 Set Clear Goals

Setting clear financial goals is a fundamental step in managing your cryptocurrency investments and emotions effectively:

- Define Your Objectives: Ask yourself why you are investing in cryptocurrencies. Are you looking for long-term wealth accumulation, funding a specific project, or diversifying your investment portfolio? Having well-defined objectives helps you make informed decisions.

- Assess Risk Tolerance: Understand your risk tolerance level. Determine how much volatility and potential loss you can comfortably withstand. This self-awareness will guide your asset allocation and investment strategy.

3.8 Stay Calm During Corrections

Cryptocurrency markets are known for their volatility, and corrections, which are temporary price declines, are a common occurrence:

- Understand Corrections: Corrections are a healthy part of any market cycle. They provide opportunities for new investors to enter and prevent unsustainable price bubbles.

- Avoid Emotional Reactions: During corrections, prices may drop significantly. Avoid impulsive decisions driven by fear or panic. Instead, stick to your investment strategy and long-term goals.

3.9 Use Stop-Loss Orders

Stop-loss orders are a risk management tool that can help protect your investments in volatile markets

- Define a Trigger Price: When setting a stop-loss order, you specify a trigger price at which the exchange or platform will automatically sell your assets.

- Limit Potential Losses: Stop-loss orders help limit potential losses during sudden price downturns. However, keep in mind that they can also trigger premature sales if not set carefully.

3.10 Regularly Review and Adjust

To adapt to the ever-changing cryptocurrency landscape, it’s essential to regularly review and adjust your investment strategy:

- Periodic Portfolio Review: Set aside time at regular intervals to assess your portfolio’s performance, market conditions, and your financial goals. This can be monthly, quarterly, or annually.

- Asset Allocation: Based on your review, consider rebalancing your portfolio. If one asset has grown significantly, it may be necessary to sell some and reinvest in underperforming assets to maintain your desired allocation.

- Stay Informed: Continue to educate yourself about emerging trends, new cryptocurrencies, and changes in regulations. Staying informed will help you make informed decisions when adjusting your strategy.

Conclusion

As you navigate the crypto landscape in 2023, remember that the best emotional solution involves staying informed, diversifying your portfolio, using secure storage methods, having confidence in your investments, seeking community support, and, if needed, seeking professional guidance. By combining emotional resilience with practical strategies, you can safeguard your crypto fortune and thrive in the world of blockchain forks and updates.

Stay empowered and make 2023 a year of financial success in the world of cryptocurrencies!

Frequently Asked Questions

Q1: How do I safeguard my crypto?

A: Safeguarding your cryptocurrency involves using secure wallets, enabling two-factor authentication, and staying vigilant against phishing attempts. Always keep your private keys and recovery phrases secret and offline.

Q2: How do you avoid losing money in crypto?

A: Avoiding losses in crypto requires research, diversification, and disciplined risk management. Don’t invest more than you can afford to lose, and never make impulsive decisions based on emotions.

Q3: Why shouldn’t you just put all your money into crypto?

A: Putting all your money into crypto is risky because the market is highly volatile. Diversifying your investments across different asset classes reduces risk and provides a more balanced portfolio.

Q4: What is the number one rule in crypto?

A: The number one rule in crypto is to do your own research (DYOR). Always thoroughly research cryptocurrencies and projects before investing. Relying on others’ advice can lead to poor decisions.

Q5: Which crypto to avoid?

A: It’s essential to avoid cryptocurrencies with suspicious or anonymous teams, unclear use cases, and no real-world adoption. Always be cautious of projects promising unrealistic returns.

Q6: How do thieves manage to steal cryptocurrency?

A: Thieves steal cryptocurrency through phishing, hacking, social engineering, and exploiting vulnerabilities. They may trick you into revealing private keys or gain unauthorized access to your wallets.

Q7: Why am I always losing on crypto?

A: Constant losses in crypto can result from impulsive trading, a lack of research, and not using risk management strategies. It’s crucial to learn from mistakes and improve your approach.

Q8: What are common mistakes that people make when investing in crypto?

A: Common mistakes include FOMO (Fear of Missing Out), emotional trading, not conducting due diligence, neglecting security, and over-leveraging positions.

Q9: Are people losing a lot of money with crypto?

A: Some people have lost substantial amounts of money in crypto due to market volatility and poor investment decisions. However, others have gained significant profits. It depends on individual strategies and risk tolerance.

Q10: Is crypto better than 401k?

A: Crypto and a 401(k) serve different purposes. Crypto is highly speculative and risky, while a 401(k) is a retirement savings plan with tax benefits and employer contributions. Diversifying between both can be a balanced approach.

Q11: When should I sell my crypto?

A: Deciding when to sell crypto depends on your investment goals, risk tolerance, and market conditions. Setting clear profit targets and stop-loss levels can help guide your selling decisions.

Q12: Is it worth holding onto my crypto?

A: Holding onto crypto can be worthwhile if you believe in the long-term potential of the project and are willing to weather market fluctuations. Consider your financial goals and risk tolerance.

Q13: What is the golden rule of crypto?

A: The golden rule of crypto is often considered Not your keys, not your coins. It emphasizes the importance of holding your private keys and not relying on exchanges to store your cryptocurrency.

Q14: What is the 4% rule in crypto?

A: The 4% rule in crypto is not as established as the 4% rule in traditional finance. It suggests that you should only withdraw or sell up to 4% of your crypto holdings annually to ensure long-term sustainability.

Q15: What is the golden rule of crypto trading?

A: The golden rule of crypto trading is Cut your losses and let your profits run. It encourages traders to set stop-loss orders to limit potential losses while allowing winning trades to continue growing.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.