To Share is to Show You Care!

In today’s financial landscape, a healthy credit score is the key to unlocking opportunities and securing a stable financial future. If you’re tired of being held back by a less-than-stellar credit score, you’re in the right place. In this blog post, we’ll unveil the best secrets for transforming your credit score from zero to hero in 2023. Let’s dive in and take control of your financial destiny!

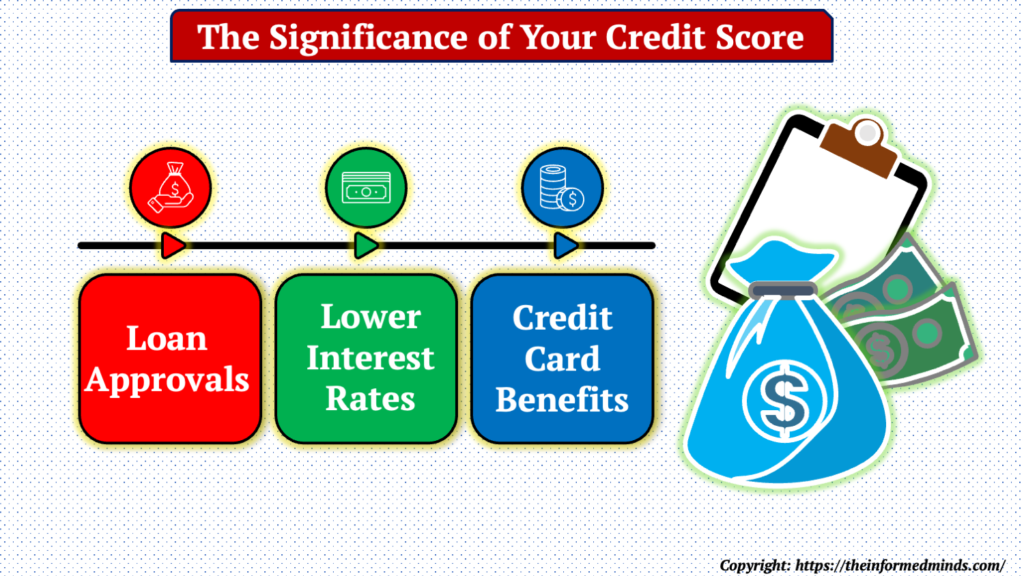

1. Why Your Credit Score Matters

Before we delve into the secrets of credit score improvement, let’s understand why your credit score is so crucial.

1.1 Loan Approvals

- A healthy credit score is crucial when you’re seeking loans, such as mortgages, car loans, or personal loans. Lenders use your credit score to evaluate your creditworthiness.

- A higher credit score makes you a more attractive borrower, increasing the chances of your loan application being approved.

- Moreover, with a good credit score, you’re more likely to secure loans with favorable terms, including lower interest rates and smaller down payment requirements.

1.2 Lower Interest Rates

- Lenders offer lower interest rates to borrowers with excellent credit scores. These lower rates translate into significant savings over the life of your loans.

- For example, if you’re applying for a 30-year mortgage, even a 1% difference in interest rates can save you tens of thousands of dollars.

1.3 Credit Card Benefits

- Credit card companies often reserve their best offers, including rewards programs, cashback incentives, and premium perks, for customers with high credit scores.

A good credit score not only allows you to qualify for these benefits but also makes it easier to upgrade to better credit cards with more attractive terms.

2. The Best Secrets to Boost Your Credit Score

2.1 Check Your Credit Report Regularly

- Obtain a free annual credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion).

- Review your report for inaccuracies, such as incorrect account information, late payments that you’ve actually made on time, or accounts you didn’t open.

- Dispute any errors with the credit bureaus to ensure your credit report accurately reflects your financial history.

2.2 Pay Bills on Time

- Payment history is one of the most significant factors affecting your credit score.

- Late payments can have a substantial negative impact on your score, so it’s crucial to pay all bills, including credit cards, loans, and utilities, on time.

- Consider setting up automatic payments or reminders to avoid missing due dates.

2.3 Reduce Credit Card Balances

- Aim to keep your credit card balances well below your credit limit, ideally below 30% utilization.

- High credit card balances relative to your credit limit can negatively affect your credit score.

- Paying down credit card debt can have a rapid positive impact on your score.

2.4 Diversify Your Credit Mix

- Lenders like to see that you can manage various types of credit responsibly.

- A mix of credit types, including credit cards, installment loans (like car loans), and a mortgage, can demonstrate your ability to handle different financial responsibilities.

2.5 Avoid Opening Too Many New Accounts

- Each credit inquiry (when a lender checks your credit) can slightly lower your credit score.

- Opening several new credit accounts within a short period can indicate financial instability to lenders, potentially lowering your score further.

- Only open new accounts when necessary and when you can manage them responsibly.

2.6 Become an Authorized User

- If you have a close family member or friend with a well-maintained credit card account, ask them to add you as an authorized user.

- Their positive payment history and credit utilization can reflect positively on your credit report.

- Ensure that the primary cardholder has a good credit history before pursuing this option.

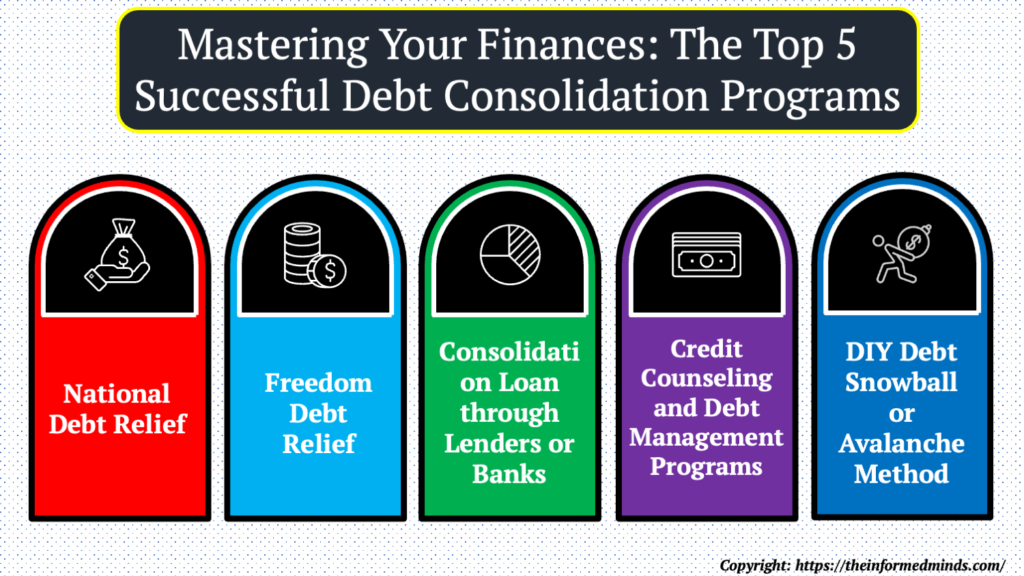

3. Top 5 Effective Debt Consolidation Programs: Take Control of Your Finances

3.1 National Debt Relief

How It Works: National Debt Relief offers a debt settlement program. They negotiate with your creditors to settle your debts for less than what you owe. You make monthly payments into an escrow account, and once a settlement is reached, the funds are used to pay off the debt.

Pros: This program can significantly reduce your total debt, often by negotiating lower balances and interest rates. National Debt Relief also provides a free consultation to assess your situation.

Cons: Debt settlement may have a negative impact on your credit score, and there are fees associated with the service.

3.2 Freedom Debt Relief

How It Works: Freedom Debt Relief is another debt settlement program. They work with your creditors to reduce the amount you owe, and you make monthly payments into a dedicated account.

Pros: Like National Debt Relief, Freedom Debt Relief can help you settle debts for less than what you owe. They have a good reputation and offer a free consultation.

Cons: Debt settlement can be detrimental to your credit score, and there are fees involved.

3.3 Consolidation Loan through Lenders or Banks

How It Works: You can apply for a debt consolidation loan from a bank or reputable online lender. If approved, you use the loan to pay off your existing debts, leaving you with a single loan payment each month.

Pros: Debt consolidation loans typically offer lower interest rates than credit cards, which can save you money over time. This approach doesn’t negatively impact your credit score.

Cons: To qualify for a consolidation loan with a low-interest rate, you often need a good credit score. If you have poor credit, you may not be eligible, or you might get a higher interest rate.

3.4 Credit Counseling and Debt Management Programs

How It Works: Non-profit credit counseling agencies offer debt management programs (DMPs). A credit counselor negotiates with your creditors to lower interest rates and create a consolidated payment plan.

Pros: DMPs can simplify your debt payments and may reduce your interest rates. These programs are not loans, so they don’t require a good credit score.

Cons: You’ll still need to repay the full principal amount, and some creditors may not participate. Additionally, enrollment in a DMP can be noted on your credit report, potentially affecting your credit score.

3.5 DIY Debt Snowball or Avalanche Method

How It Works: This approach doesn’t involve a formal program but relies on personal financial discipline. You prioritize and pay off debts one by one, starting with the smallest (Debt Snowball) or highest interest rate (Debt Avalanche) until all debts are paid.

Pros: It’s cost-effective, and you maintain full control of your finances. It can also positively impact your credit score over time.

Cons: It requires strong self-discipline, and it may take longer to become debt-free compared to other consolidation methods.

Before choosing a debt consolidation program, it’s crucial to assess your financial situation, including your credit score, the types of debts you have, and your ability to make payments. Consult with a financial advisor or credit counselor to determine which program aligns best with your needs and goals. Additionally, be cautious of debt consolidation scams and ensure you work with reputable organizations.

Conclusion

By understanding these details and applying the best practices for credit score improvement, you can take control of your financial future and work towards achieving a higher credit score in 2023.

Frequently asked questions

Q1: How to go from 0 to 700 credit score?

A: To go from a 0 credit score to 700, start by establishing credit with a secured credit card or becoming an authorized user on someone else’s credit card. Make on-time payments, keep credit card balances low, and diversify your credit mix. Over time, your score will improve.

Q2: How do you fix a 0 credit score?

A: To fix a 0 credit score, you need to start building credit. Begin with secured credit cards or becoming an authorized user on a family member’s card. Consistently make on-time payments and manage your credit responsibly.

Q3: How to go from 0 credit score to 600?

A: To move from 0 to a 600 credit score, follow the steps mentioned earlier and focus on responsible credit use. Timely payments and reducing credit card balances are essential.

Q4: How to get 800 credit score from 0?

A: Achieving an 800 credit score from 0 takes time and responsible credit management. Start by building a positive credit history with small accounts and gradually work your way up.

Q5: How to go from 0 to 750 credit score?

A: Going from 0 to a 750 credit score involves consistent on-time payments, keeping credit utilization low, and maintaining a mix of credit types. Patience is key.

Q6: How long does it take to get a 850 credit score from 0?

A: Building an 850 credit score from 0 is extremely challenging and may take several years of responsible credit management. Few individuals ever reach the perfect 850 score.

Q7: How fast can you raise your credit score from 0?

A: It varies, but you can start seeing improvements in as little as a few months with responsible credit use. However, significant increases may take a year or more.

Q8: How long does it take to get a good credit score from 0?

A: It typically takes around 6 to 12 months of responsible credit management to establish a good credit score.

Q9: Is 0 credit bad credit?

A: Having a 0 credit score isn’t necessarily bad, but it means you have no credit history. Lenders may see you as a higher risk borrower until you establish credit.

Q10: How long does it take to build credit from 0 to 800?

A: Building credit from 0 to 800 can take many years. It’s a gradual process that depends on your financial habits and the types of credit you use.

Q11: Can I pay someone to fix my credit?

A: Yes, there are credit repair services that can help you dispute errors on your credit report. However, be cautious and research any service you consider using.

Q12: How to raise your credit score 200 points in 30 days?

A: Raising your credit score by 200 points in 30 days is extremely challenging and may not be possible through legitimate means. Focus on long-term credit improvement instead.

Q13: Can a 25 year old have an 800 credit score?

A: Yes, it’s possible for a 25-year-old to have an 800 credit score if they have a long history of responsible credit use.

Q14: Is 6 credit cards too much?

A: Six credit cards may not be too many if you can manage them responsibly. It depends on your financial situation and ability to make payments on time.

Q15: What is the average US credit score?

A: The average US credit score typically hovers around the mid-700s, but it can vary by region and demographic factors.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.