To Share is to Show You Care!

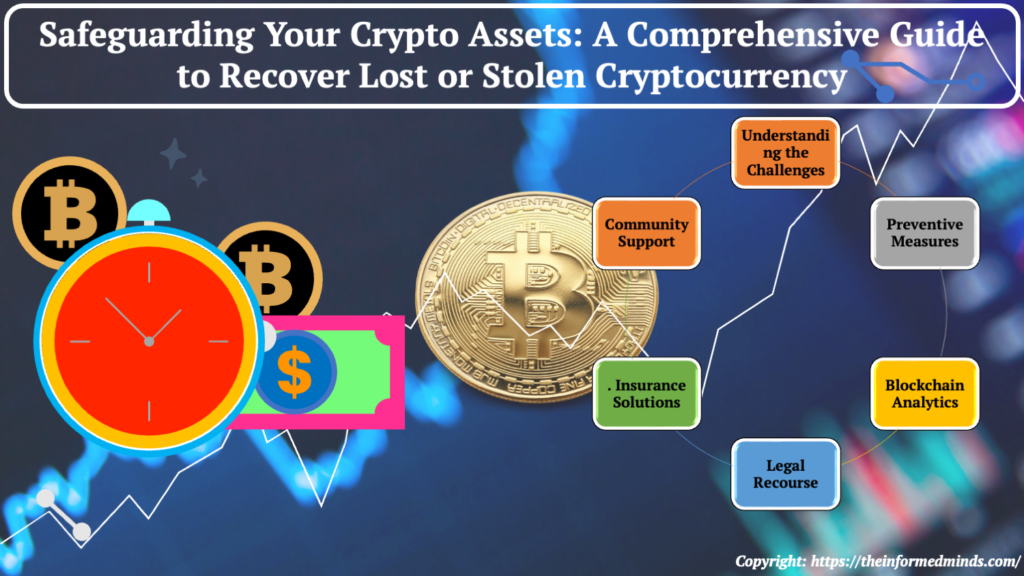

In the ever-evolving landscape of cryptocurrency, the security of digital assets is paramount. However, despite the robust security measures implemented by blockchain technologies, the risk of losing or having your cryptocurrency stolen is still a concern for many investors. In this blog post, we will explore the common challenges associated with the limited ability to recover lost or stolen cryptocurrency and provide practical solutions to enhance the security of your digital assets.

1. Understanding the Challenges

Lack of Centralized Authority: Cryptocurrencies operate on decentralized networks, meaning there’s no central authority governing or overseeing transactions. This decentralization, while a strength in terms of security, can make it challenging to have a central entity to turn to for dispute resolution or recovery of lost funds.

Irreversible Transactions: Once a cryptocurrency transaction is confirmed and added to the blockchain, it becomes irreversible. This characteristic, while enhancing security and preventing fraud, poses a challenge in terms of recovering funds once they have been transferred.

2. Preventive Measures

Secure Wallet Practices: Utilizing hardware wallets or reputable software wallets with advanced security features is crucial. Hardware wallets, in particular, store private keys offline, making them less susceptible to online hacking attempts.

Two-Factor Authentication (2FA): Enabling 2FA adds an extra layer of security to your cryptocurrency accounts. This typically involves a secondary verification step, such as a code sent to your mobile device, ensuring that even if your password is compromised, unauthorized access is still difficult.

3. Blockchain Analytics

Traceability: Blockchain analytics tools allow users to trace the movement of funds on the blockchain. By analyzing transactions and wallet addresses, users can potentially identify patterns or anomalies that could indicate fraudulent activity.

Monitoring Tools: Real-time monitoring tools can provide alerts for suspicious activities or unauthorized transactions. These tools help users stay informed about the movement of their funds and can trigger a swift response in case of any irregularities.

4. Legal Recourse

Document Transactions: Maintaining detailed records of cryptocurrency transactions is essential. This includes keeping track of wallet addresses involved, transaction dates, and unique transaction IDs. This documentation can be valuable when seeking legal assistance.

Legal Consultation: In the event of a loss, consulting with legal professionals who specialize in cryptocurrency issues is advisable. They can provide guidance on potential legal avenues for recovering lost funds and advise on the best course of action.

5. Insurance Solutions

Crypto Insurance: Some companies offer insurance policies specifically designed to cover losses due to theft or hacking incidents. These policies may provide a level of financial protection in case of unforeseen events.

Policy Terms: Understanding the terms and conditions of any insurance policy is crucial. This includes knowing the coverage limits, exclusions, and the process for filing a claim. Not all losses may be covered, so it’s essential to be aware of the policy’s specifics.

6. Community Support

Online Forums: Engaging with the cryptocurrency community through forums and social media platforms can be beneficial. Sharing experiences, learning from others who have faced similar situations, and seeking advice can provide valuable insights.

Report Incidents: Reporting any theft or loss to relevant authorities and online platforms is essential. This not only helps in potentially recovering funds but also contributes to raising awareness within the community about specific threats or vulnerabilities.

Conclusion

While the limited ability to recover lost or stolen cryptocurrency poses a challenge, implementing a combination of preventive measures, utilizing blockchain analytics, exploring legal options, considering insurance solutions, and seeking community support can significantly enhance the security of your digital assets. Stay vigilant, stay informed, and take proactive steps to protect your cryptocurrency investments in this dynamic and evolving landscape.

Remember, proactive measures are key to mitigating risks and ensuring the safety of your cryptocurrency holdings. By adopting a comprehensive approach to security, you can minimize the impact of potential losses and enjoy a more secure and confident investment experience.

Frequently Asked Questions

Q1: Can you get crypto back if stolen?

A: In most cases, recovering stolen cryptocurrency is challenging due to the decentralized nature of blockchain transactions. Once a transaction is confirmed, it’s irreversible. However, adopting preventive measures and seeking legal advice may improve the chances of recovering lost funds.

Q2: How do you recover loss in cryptocurrency?

A: Recovering losses in cryptocurrency involves a combination of preventive measures, such as secure wallet practices and 2FA, documentation of transactions, legal consultation, and potentially exploring insurance solutions. Blockchain analytics tools and community support also play a role in enhancing security.

Q3: What to do if you are a victim of a crypto scam?

A: If you fall victim to a crypto scam, report the incident to relevant authorities and online platforms. Seek legal advice to explore potential recovery options. Engage with the cryptocurrency community to share your experience and raise awareness about the scam.

Q4: What happens to lost cryptocurrency?

A: Lost cryptocurrency, whether due to forgotten passwords or inaccessible wallets, remains on the blockchain but becomes inaccessible. Unlike traditional banks, there is no account recovery process. Users are urged to store private keys securely and explore potential recovery options if available.

Q5: Can I get my money back if I got scammed from Bitcoin?

A: Recovering money lost to a Bitcoin scam is challenging. However, prompt reporting to authorities, seeking legal assistance, and collaborating with relevant platforms may improve the chances of taking action against scammers or recovering funds.

Q6: Can Coinbase recover stolen crypto?

A: Coinbase and similar platforms may not have the capability to recover stolen cryptocurrency directly. However, they may assist in investigations and provide information to law enforcement agencies. Users should report incidents promptly and work closely with both the platform and legal professionals.

Q7: Is crypto asset recovery legit?

A: Legitimate crypto asset recovery services exist, offering assistance in cases of lost or stolen funds. However, it’s crucial to research and choose reputable services, as the crypto recovery industry also attracts scams. Exercise caution and seek recommendations before engaging with any recovery service.

Q8: How to spot a Bitcoin scammer?

A: Spotting a Bitcoin scam involves being cautious of unsolicited offers, verifying the legitimacy of exchanges, avoiding promises of guaranteed returns, and conducting thorough research. Scammers often use phishing emails, fake websites, and social engineering tactics to deceive users.

Q9: Can a crypto scammer be traced?

A: Tracing a crypto scammer depends on the level of sophistication used. While blockchain transactions are pseudonymous, forensic analysis and collaboration with law enforcement agencies may lead to identifying perpetrators. Reporting scams promptly enhances the chances of tracking down scammers.

Q10: Can you go to jail for a cryptocurrency scam?

A: Engaging in cryptocurrency scams, especially those involving fraud or theft, can lead to legal consequences. Depending on the jurisdiction, individuals involved in scams may face criminal charges, fines, and imprisonment. Legal penalties aim to deter fraudulent activities in the cryptocurrency space.

Q11: What is the punishment for a crypto scam?

A: Punishments for cryptocurrency scams vary by jurisdiction. Offenders may face fines, restitution orders, and imprisonment. The severity of penalties depends on the scale of the scam, the financial losses incurred, and the specific legal frameworks in place.

Q12: Can a private key be recovered if lost?

A: In general, private keys cannot be recovered if lost. It’s crucial to securely store and back up private keys to prevent permanent loss of access to cryptocurrency funds. Users should explore wallet recovery options and follow best practices for key management.

Q13: Can I get my Bitcoin back?

A: Recovering Bitcoin depends on the circumstances. If lost due to theft, scams, or technical issues, it’s challenging but not impossible. Prompt reporting, legal assistance, and collaboration with relevant platforms increase the likelihood of taking action against scammers or exploring recovery options. However, success is not guaranteed.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.