To Share is to Show You Care!

Welcome to the ultimate guide on mastering the art of budgeting in 2023! In this blog post, we’ll explore the best strategies to navigate the emotional rollercoaster of family finances, providing you with practical tips to achieve financial freedom.

1. Understanding the Importance of Budgeting

In today’s fast-paced world, effective budgeting is crucial for maintaining financial stability. By creating a budget, you gain control over your finances, reduce stress, and pave the way for achieving your financial goals.

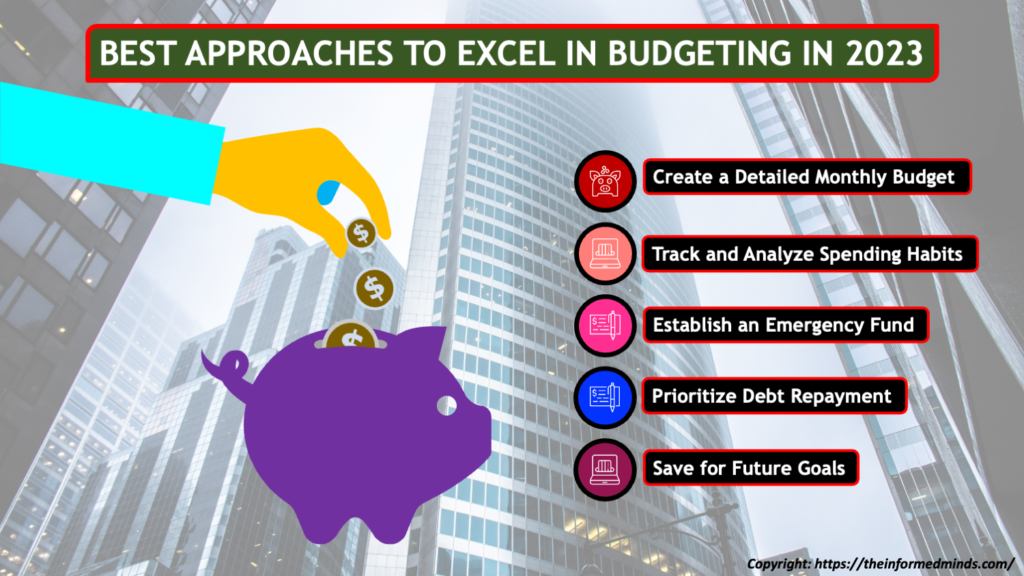

2. Top Strategies for Mastering Budgeting in 2023

2.1 Create a Detailed Monthly Budget

- List all sources of income: Begin by documenting all sources of income, including salaries, bonuses, and any other additional income streams.

- Break down expenses into categories: Categorize your expenses, such as housing, groceries, utilities, entertainment, and miscellaneous. This provides a clear overview of where your money is going.

- Allocate a specific amount to each category: Assign a realistic and manageable amount to each spending category based on your income. This ensures that you have a designated portion for all essential expenses.

2.2 Track and Analyze Spending Habits

- Use budgeting apps to monitor your expenses: Leverage the power of budgeting apps like Mint or YNAB to effortlessly track your spending. These apps categorize transactions and offer insights into your financial habits.

- Identify areas where you can cut back: Analyze your spending patterns to pinpoint areas where you can make cuts without compromising your essential needs. This may include dining out less frequently or finding more cost-effective alternatives.

2.3 Establish an Emergency Fund

- Start an emergency fund for unexpected expenses: Set aside a dedicated fund to cover unforeseen circumstances, such as medical emergencies or car repairs. This financial cushion provides peace of mind and prevents the need to dip into long-term savings.

- Aim for at least three to six months’ worth of living expenses: Strive to build an emergency fund equivalent to three to six months’ worth of your essential living expenses. This ensures you’re well-prepared for any financial curveballs life may throw at you.

2.4 Prioritize Debt Repayment

- List all outstanding debts: Make a comprehensive list of all your debts, including credit cards, loans, and any other outstanding balances.

- Create a debt repayment plan: Prioritize paying off high-interest debts first while making minimum payments on others. Consider debt consolidation strategies to streamline repayment.

2.5 Save for Future Goals

- Define short and long-term financial goals: Clearly outline your financial objectives, whether it’s saving for a vacation, buying a home, or funding your children’s education.

- Allocate funds towards each goal: Break down your goals into manageable milestones and allocate a portion of your budget towards achieving them. This disciplined approach ensures progress towards your aspirations.

3. Navigating the Emotional Rollercoaster

Managing family finances can be emotionally challenging. Here are tips to stay on track

3.1 Open Communication

- Regularly discuss financial goals with your family: Schedule periodic family meetings to openly discuss financial goals, ensuring everyone is on the same page.

- Create a shared vision for the future: Develop a collective vision that aligns with your family’s values and aspirations. This shared vision fosters a sense of unity and commitment.

3.2 Celebrate Financial Milestones

- Acknowledge and celebrate achievements: When you reach financial milestones, take the time to celebrate. This could be paying off a significant debt or reaching a savings goal.

- Set new goals to maintain motivation: After celebrating, set new financial goals to keep the momentum going. This continuous cycle of achievement and setting new objectives maintains enthusiasm.

3.3 Cultivate Financial Mindfulness

- Practice mindful spending: Before making a purchase, consider its impact on your overall budget. Ask yourself if it aligns with your financial goals and if there are more cost-effective alternatives.

- Reflect on financial decisions: Periodically reflect on your financial choices. This self-awareness can help you identify patterns, learn from mistakes, and make more informed decisions in the future.

3.4 Build a Support System

- Share financial challenges with trusted friends or family: Don’t be afraid to discuss financial difficulties with those you trust. Sometimes, external perspectives can provide valuable insights and emotional support.

- Seek professional advice when needed: If facing complex financial issues, consider consulting with a financial advisor. Their expertise can offer tailored solutions and alleviate the emotional burden.

3.5 Practice Self-Care

- Recognize the impact of financial stress on well-being: Understand that financial stress can affect mental and emotional health. Prioritize self-care activities to maintain overall well-being.

- Engage in stress-relieving activities: Incorporate activities like exercise, meditation, or hobbies into your routine. These activities help manage stress and contribute to a positive mindset.

Conclusion

Congratulations! You’ve taken the first steps towards mastering the art of budgeting in 2023. By implementing these strategies and embracing the emotional journey, you’re on your way to achieving financial freedom for your family.

Remember, consistency is key. Start your budgeting journey today and witness the positive impact it can have on your family’s financial well-being!

Frequently Asked Questions

Q1: What is the best way to manage family finances?

A: The best way to manage family finances is by creating a detailed monthly budget, tracking expenses, establishing an emergency fund, prioritizing debt repayment, and saving for future goals. Open communication and celebrating financial milestones also play crucial roles.

Q2: What is family financial management?

A: Family financial management involves the strategic planning, organization, and control of a family’s monetary resources. It includes budgeting, tracking expenses, saving, investing, and making informed financial decisions to achieve short and long-term goals.

Q3: How can you effectively manage the family income?

A: You can effectively manage family income by creating a comprehensive budget, prioritizing essential expenses, tracking spending habits, saving a portion for emergencies, paying off debts, and allocating funds toward specific financial goals.

Q4: How do I teach my adult child financial responsibility?

A: Teach financial responsibility to your adult child by setting a good example, providing practical lessons on budgeting and saving, encouraging them to make informed financial decisions, and gradually giving them more financial independence.

Q5: What does the Bible say about family finances?

A: The Bible emphasizes principles such as stewardship, generosity, and avoiding debt. Proverbs 21:20 encourages wise financial planning, while 1 Timothy 5:8 underscores the importance of providing for one’s family.

Q6: What is a simple rule for managing your finances?

A: A simple rule for managing finances is the 50/20/30 budget rule, where 50% of income goes to needs, 20% to savings and debt repayment, and 30% to discretionary spending.

Q7: What is the 50 20 30 budget rule?

A: The 50/20/30 budget rule allocates 50% of income to essential needs, 20% to savings and debt repayment, and 30% to discretionary spending on non-essential items.

Q8: What are the 3 types of family budget?

A: The three types of family budgets are: traditional budget (income vs. expenses), zero-based budget (allocating every dollar), and the envelope system (using cash for specific categories).

Q9: What is an example of a family financial plan?

A: An example of a family financial plan includes setting financial goals, creating a budget, saving for emergencies and future expenses, investing for long-term growth, and regularly reviewing and adjusting the plan.

Q10: What are the 5 sources of family income?

A: The five sources of family income are employment wages, self-employment income, rental income, investment income, and government benefits or assistance.

Q11: What are the 9 components of a family budget?

A: The nine components of a family budget include income, fixed expenses, variable expenses, discretionary spending, emergency fund contributions, debt repayment, savings, investments, and financial goals.

Q12: How do I stop enabling financial irresponsibility?

A: To stop enabling financial irresponsibility, establish clear boundaries, encourage accountability, and provide educational resources on financial literacy. Avoid bailing out your adult child from the consequences of poor financial decisions.

Q13: How do you deal with a financially irresponsible adult child?

A: Deal with a financially irresponsible adult child by having open and honest conversations, setting expectations and boundaries, offering guidance on budgeting and financial planning, and encouraging them to take responsibility for their financial choices.

Q14: When your grown child makes bad financial decisions?

A: When your grown child makes bad financial decisions, provide support without enabling, offer guidance on improving financial habits, and encourage them to seek professional advice if needed. Focus on helping them learn from their mistakes and make better choices in the future.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.