To Share is to Show You Care!

In the world of cryptocurrency, margin trading and leverage offer lucrative opportunities for investors to amplify their gains. However, these strategies come with inherent risks that can lead to substantial losses if not managed properly. Understanding and mitigating these risks are crucial for any trader looking to navigate the volatile crypto markets successfully.

1. The Risks Associated with Margin Trading and Leverage in Cryptocurrency

Margin trading and leverage enable traders to control larger positions in the market with a fraction of the capital required for traditional trading. While this can magnify profits, it also exposes traders to amplified risks.

1.1 Market Volatility

- Cryptocurrency markets are known for their extreme volatility, characterized by rapid and unpredictable price movements.

- Margin trading exacerbates this volatility as traders can open larger positions with borrowed funds.

- While increased volatility can lead to substantial profits, it also amplifies the potential for losses if the market moves against the trader’s position.

1.2 Liquidation Risk

- Margin trading involves borrowing funds from the exchange to amplify trading positions.

- If the market moves unfavorably, the exchange may liquidate the trader’s position to cover potential losses.

- Liquidation can result in the loss of the entire margin amount and even additional funds if the market experiences significant volatility.

1.3 Interest Costs

- Margin trading typically involves borrowing funds from the exchange or other traders, which incurs interest costs.

- These interest costs can accumulate over time, especially if positions are held for extended periods.

- Traders need to consider interest costs when calculating the profitability of their trades and managing their overall risk exposure.

1.4 Emotional Pressure

- Trading with leverage can amplify emotions such as fear, greed, and anxiety.

- Fear of missing out (FOMO) may lead traders to take excessive risks, while panic selling during market downturns can result in significant losses.

- Emotional decision-making can cloud judgment and lead to impulsive trading actions, which can be detrimental to overall profitability.

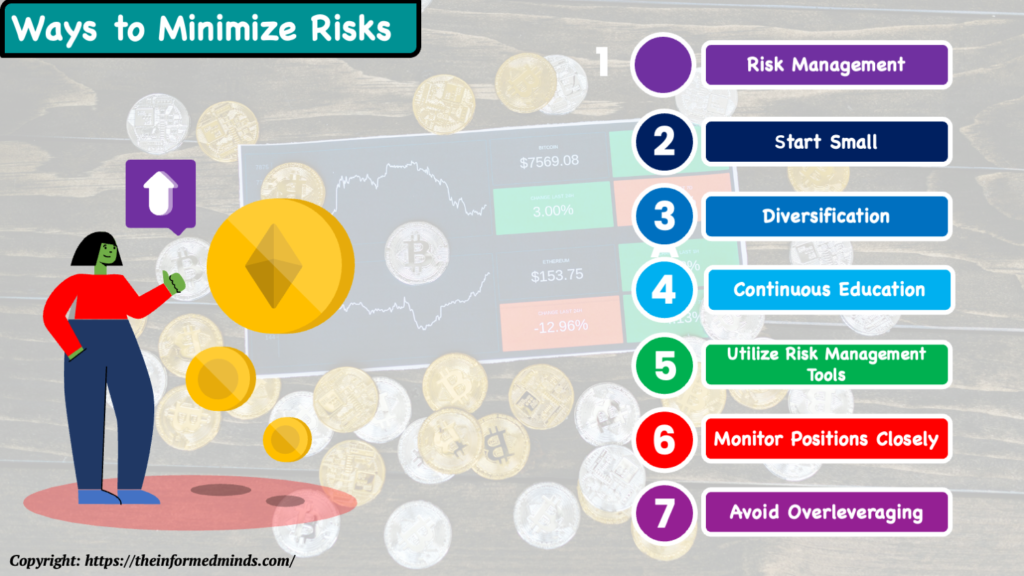

2. Solutions to Mitigate Risks

While margin trading and leverage carry inherent risks, traders can implement several strategies to mitigate these risks effectively.

2.1 Risk Management

- Implementing robust risk management strategies is essential for mitigating the risks associated with margin trading.

- Setting clear stop-loss orders helps limit potential losses by automatically closing positions at predefined price levels.

- Adhering to predefined risk-reward ratios ensures that potential profits outweigh potential losses for each trade.

2.2 Start Small

- Beginners should start with small leverage amounts and gradually increase exposure as they gain experience and confidence in their trading strategies.

- Starting small allows traders to learn from their mistakes without risking significant capital.

2.3 Diversification

- Diversifying trading portfolios across multiple assets helps spread risk and reduce the impact of adverse price movements on individual positions.

- By diversifying, traders can protect themselves against the potential failure of any single asset or market segment.

2.4 Continuous Education

- Staying informed about market trends, news, and developments in the cryptocurrency space is crucial for making informed trading decisions.

- Continuous learning helps traders adapt to changing market conditions and identify new opportunities for profit.

2.5 Utilize Risk Management Tools

- Many exchanges offer risk management tools such as trailing stop-loss orders and take-profit orders.

- Utilizing these tools helps automate risk management and minimizes emotional decision-making during trading.

2.6 Monitor Positions Closely

- Keeping a close eye on open positions and market movements is essential for successful margin trading.

- Setting alerts for significant price movements allows traders to react promptly to changes in market conditions and adjust their strategies accordingly.

2.7 Avoid Overleveraging

- Overleveraging positions significantly increases the risk of liquidation and substantial losses.

- Traders should resist the temptation to overleverage and only use leverage amounts that they can afford to lose without significant financial impact.

Conclusion

Margin trading and leverage offer the potential for significant profits in the cryptocurrency markets, but they also carry substantial risks. By understanding these risks and implementing effective risk management strategies, traders can navigate the volatile crypto landscape with greater confidence and minimize the likelihood of catastrophic losses. Remember, disciplined trading and prudent risk management are key to long-term success in margin trading.

Frequently Asked Questions

Q1: What are the risks of margin trading crypto?

A: Margin trading crypto carries several risks, including increased market volatility, liquidation risk, interest costs, and emotional pressure. Traders can face significant losses if the market moves against their positions.

Q2: Is it legal to trade crypto with leverage in the US?

A: Yes, it is legal to trade crypto with leverage in the US, but regulations vary by state and trading platform. Traders must adhere to the rules and regulations set forth by regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Q3: What is leverage and margin in crypto?

A: Leverage allows traders to control larger positions in the market with a fraction of the capital required for traditional trading. Margin is the collateral that traders must deposit to open leveraged positions. In crypto trading, leverage and margin enable traders to amplify potential profits but also increase the risk of significant losses.

Q4: How much can you lose leverage trading crypto?

A: The amount you can lose when leverage trading crypto depends on several factors, including the size of your leveraged position, market volatility, and risk management strategies. Traders can potentially lose more than their initial investment when trading with leverage, leading to substantial losses.

Q5: What are the disadvantages of margin trading?

A: The disadvantages of margin trading include increased risk of liquidation, interest costs associated with borrowing funds, emotional pressure, and the potential for significant losses if the market moves against the trader’s position.

Q6: What are the cons of margin?

A: The cons of margin trading include the requirement to deposit collateral (margin), potential for liquidation if the market moves against the trader’s position, interest costs, and increased emotional pressure due to amplified gains and losses.

Q7: Why is leverage trading banned in the US?

A: Leverage trading is not banned in the US, but it is heavily regulated to protect investors from excessive risks. Regulatory bodies such as the CFTC and SEC impose strict rules and limitations on leverage trading to safeguard investors and maintain market integrity.

Q8: Should I trade crypto with leverage?

A: Whether to trade crypto with leverage depends on your risk tolerance, trading experience, and understanding of market dynamics. Leverage can amplify both profits and losses, so traders should carefully consider their risk management strategies before engaging in leveraged trading.

Q9: Is 10x leverage safe?

A: The safety of 10x leverage depends on various factors, including market conditions, volatility, and individual risk tolerance. While 10x leverage can amplify potential profits, it also increases the risk of significant losses if the market moves against the trader’s position.

Q10: Do you have to pay back leverage crypto?

A: Yes, traders must eventually repay any borrowed funds used for leverage trading, along with any associated interest costs. Failure to do so can result in liquidation of positions and additional penalties.

Q11: What does 100% leverage mean in crypto trading?

A: 100% leverage in crypto trading means that the trader is borrowing the entire amount required to open a position, effectively trading with borrowed funds equal to their initial investment. This amplifies both potential profits and losses.

Q12: What is the difference between margin trading and leverage?

A: Margin trading involves borrowing funds to amplify trading positions, while leverage refers to the ability to control larger positions in the market with a fraction of the capital required for traditional trading. Leverage is the mechanism used in margin trading to amplify gains and losses.

Q13: Can I lose all my money in leverage trading?

A: Yes, it is possible to lose all your money in leverage trading if the market moves significantly against your positions. Leverage amplifies both profits and losses, so traders should exercise caution and implement effective risk management strategies.

Q14: What happens if you lose money trading with leverage?

A: If you lose money trading with leverage, you may face liquidation of your positions if your losses exceed your margin balance. Additionally, you are still responsible for repaying any borrowed funds and any associated interest costs.

Q15: Can you go negative with leverage trading?

A: Yes, you can go negative with leverage trading if your losses exceed your initial investment and available margin. This can result in owing money to the exchange or brokerage, leading to financial losses and potential liquidation of positions.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.