To Share is to Show You Care!

In the bustling realm of cryptocurrency, where innovation and speculation collide, one persistent challenge plagues both investors and enthusiasts alike: the lack of transparency and clarity surrounding project and token fundamentals. As the crypto space burgeons with new projects and tokens vying for attention, discerning the genuine opportunities from the dubious ones becomes increasingly convoluted. Fortunately, there are actionable solutions to navigate through this murky terrain and empower investors to make informed decisions.

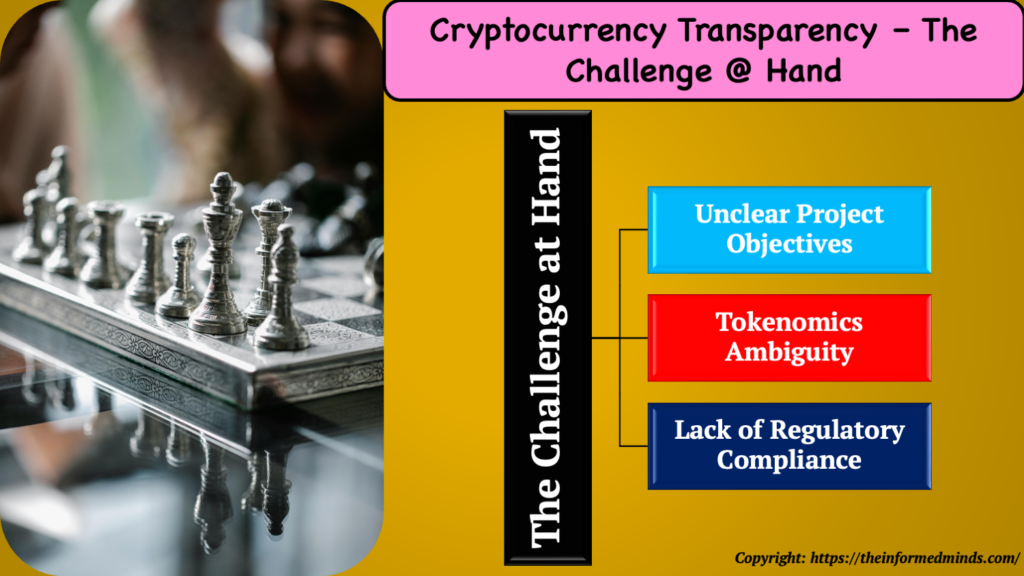

1. The Challenge at Hand

In the dynamic world of cryptocurrency, the absence of transparent information and clear fundamentals poses significant hurdles:

1.1 Unclear Project Objectives

- In the realm of cryptocurrency, many projects fail to clearly articulate their objectives and long-term vision. This lack of clarity leaves potential investors and stakeholders uncertain about the project’s purpose, goals, and intended outcomes.

- Without a clear understanding of a project’s objectives, investors may struggle to assess its viability and potential for long-term success. Unclear project objectives can also hinder community engagement and adoption, as stakeholders may be hesitant to support a project without a clear sense of direction.

- Clear and transparent communication of project objectives through mediums such as whitepapers, project websites, and official announcements is crucial for fostering trust and confidence among investors and stakeholders.

2. Tokenomics Ambiguity

- Tokenomics refers to the economic model and mechanics governing a cryptocurrency token. It encompasses factors such as token distribution, supply dynamics, utility within the ecosystem, and mechanisms for incentivizing participation.

- Many crypto projects have intricate tokenomics models that can be difficult for investors to decipher. Ambiguity surrounding tokenomics can lead to confusion and uncertainty regarding the token’s value proposition, utility, and potential for appreciation.

- Investors rely on a clear understanding of tokenomics to evaluate investment opportunities and assess the long-term viability of a project. Without transparent and comprehensible tokenomics, investors may be hesitant to allocate capital to a project, leading to reduced liquidity and adoption.

3. Lack of Regulatory Compliance

- Regulatory compliance is a significant concern in the cryptocurrency space, as many projects operate in a regulatory gray area characterized by evolving regulations and enforcement measures.

- The lack of clear regulatory guidance and compliance frameworks can expose investors and projects to legal risks, regulatory scrutiny, and potential penalties. Projects that fail to adhere to applicable regulations may face legal challenges, fines, or even shutdowns, impacting investor confidence and market stability.

- Regulatory compliance is essential for fostering investor trust, ensuring market integrity, and mitigating systemic risks associated with fraudulent or non-compliant projects. Projects that prioritize regulatory compliance demonstrate commitment to accountability, transparency, and long-term sustainability.

2. Solutions to Enhance Transparency and Clarity

To address the pervasive lack of transparency and clarity in the crypto space, stakeholders must champion initiatives aimed at fostering greater accountability and trust. Here are actionable solutions.

2.1 Comprehensive Whitepapers

Crypto projects should prioritize the creation of comprehensive whitepapers that elucidate their objectives, technological innovations, tokenomics model, and roadmap in a clear and concise manner. A detailed whitepaper serves as a foundational document that enables investors to assess the project’s fundamentals and long-term viability.

2.2 Audited Tokenomics

Conducting third-party audits of tokenomics models enhances credibility and transparency. Independent audits provide investors with assurance regarding the accuracy and integrity of the tokenomics structure, mitigating the risk of manipulation or exploitation.

2.3 Regulatory Compliance

Crypto projects must proactively engage with regulatory authorities to ensure compliance with relevant laws and regulations. Embracing regulatory clarity fosters investor confidence and mitigates legal uncertainties, thereby strengthening the legitimacy of the project.

2.4 Community Engagement and Transparency

Establishing open channels of communication with the community fosters trust and transparency. Regular updates, AMA (Ask Me Anything) sessions, and community-driven initiatives enable projects to address concerns, solicit feedback, and demonstrate accountability to their stakeholders.

2.5 Due Diligence and Research

Investors should exercise due diligence and conduct thorough research before investing in a crypto project. Scrutinizing the team’s credentials, project roadmap, tokenomics model, and community engagement can provide valuable insights into the project’s credibility and potential risks.

Conclusion

In the rapidly evolving landscape of cryptocurrency, transparency and clarity are indispensable pillars that underpin investor confidence and market integrity. By embracing proactive measures such as comprehensive whitepapers, audited tokenomics, regulatory compliance, community engagement, and diligent research, stakeholders can collectively mitigate the challenges posed by the lack of transparency and clarity in the crypto space. Together, we can cultivate an ecosystem built on trust, accountability, and innovation, empowering investors to navigate the crypto landscape with confidence and clarity.

Frequently Asked Questions

Q1: Why is transparency important in crypto?

A: Transparency is crucial in crypto to build trust among investors and users. It ensures that information about the project, its team, tokenomics, and operations is readily available and accessible. Without transparency, investors may be wary of potential scams or fraudulent activities within the crypto space.

Q2: What is the problem with crypto fundamental analysis?

A: The main problem with crypto fundamental analysis is the lack of standardized metrics and reliable data. Unlike traditional financial markets, cryptocurrencies often lack clear fundamentals such as revenue, earnings, or cash flow. This makes it challenging for analysts to evaluate the intrinsic value of crypto assets based on fundamental factors alone.

Q3: What is the main problem in regulating cryptocurrencies?

A: The main problem in regulating cryptocurrencies lies in the decentralized and global nature of the crypto ecosystem. Traditional regulatory frameworks may struggle to keep pace with the rapidly evolving landscape of cryptocurrencies, leading to regulatory uncertainty, enforcement challenges, and jurisdictional conflicts.

Q4: What are scalability issues with crypto?

A: Scalability issues in crypto refer to the challenges associated with handling increasing transaction volumes and maintaining network performance as the user base grows. Issues such as slow transaction processing times and high fees can hinder the mainstream adoption of cryptocurrencies for everyday transactions.

Q5: What does transparency mean in cryptocurrency?

A: Transparency in cryptocurrency refers to the openness and accessibility of information related to a project, its development, governance, and tokenomics. Transparent projects provide clear documentation, regular updates, and open communication channels to foster trust and accountability within the community.

Q6: What is transparency in cryptocurrency?

A: Transparency in cryptocurrency entails making relevant information about a project or token readily available to stakeholders. This includes details about the project team, whitepapers, code repositories, token distribution, and financial disclosures. Transparent practices promote trust and confidence among investors and users.

Q7: What is fundamentals in crypto?

A: Fundamentals in crypto encompass various factors that contribute to the intrinsic value and long-term viability of a cryptocurrency project. This includes factors such as the project’s technology, development team, use case, adoption potential, tokenomics, regulatory compliance, and market demand.

Q8: How do you assess a crypto project?

A: Assessing a crypto project involves conducting thorough due diligence and evaluating various factors such as the project’s whitepaper, team expertise, technology, community engagement, roadmap, partnerships, regulatory compliance, and market demand. It also involves analyzing the tokenomics and assessing the project’s potential for long-term growth and adoption.

Q9: What is fundamental analysis of crypto coins?

A: Fundamental analysis of crypto coins involves evaluating the intrinsic value and long-term prospects of a cryptocurrency based on factors such as technology, team, adoption potential, use case, market demand, competition, and regulatory environment. It aims to assess whether a crypto coin is undervalued or overvalued based on fundamental factors.

Q10: Which crypto has lost the most value?

A: Cryptocurrencies are known for their volatility, and many have experienced significant price fluctuations. Specific cryptocurrencies that have lost the most value at any given time can vary based on market conditions. However, historically, some cryptocurrencies have experienced substantial declines in value during market downturns or due to other factors.

Q11: Who regulates crypto in the US?

A: In the United States, cryptocurrency regulation is overseen by various regulatory agencies, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FinCEN), and the Internal Revenue Service (IRS). Regulation can vary based on the specific nature of the cryptocurrency and its use case.

Q12: Why are banks against crypto?

A: Banks may be cautious or opposed to cryptocurrencies due to concerns about regulatory compliance, money laundering, terrorism financing, consumer protection, and systemic risks. Cryptocurrencies challenge the traditional banking system by offering decentralized alternatives to financial services, which can disrupt existing business models and revenue streams for banks.

Q13: How do you fix scalability problems?

A: Scalability problems in cryptocurrencies can be addressed through various technical solutions such as increasing block sizes, implementing off-chain scaling solutions like the Lightning Network, adopting sharding techniques, optimizing consensus mechanisms, and exploring layer 2 scaling solutions. Collaboration among developers, researchers, and stakeholders is essential to finding sustainable scalability solutions.

Q14: How do you resolve scalability issues?

A: Resolving scalability issues in cryptocurrencies requires a multi-faceted approach that involves technical innovation, consensus among stakeholders, and effective governance mechanisms. Solutions may include optimizing network protocols, implementing layer 2 scaling solutions, improving transaction throughput, and fostering interoperability between different blockchain networks.

Q15: How do you solve blockchain scalability problem?

A: Solving the blockchain scalability problem requires implementing a combination of on-chain and off-chain scaling solutions, improving consensus algorithms, enhancing network infrastructure, and fostering collaboration among developers, miners, and users. Additionally, exploring novel approaches such as sharding, sidechains, and state channels can contribute to mitigating scalability challenges and supporting the mass adoption of blockchain technology.

The Informed Minds

I'm Vijay Kumar, a consultant with 20+ years of experience specializing in Home, Lifestyle, and Technology. From DIY and Home Improvement to Interior Design and Personal Finance, I've worked with diverse clients, offering tailored solutions to their needs. Through this blog, I share my expertise, providing valuable insights and practical advice for free. Together, let's make our homes better and embrace the latest in lifestyle and technology for a brighter future.